Advertisement|Remove ads.

Vertex Stock Sinks 12% As Pipeline Setbacks Trigger Wall Street Skepticism: But Retail Sees Opportunity

Shares of Vertex Pharmaceuticals (VRTX) slumped 12% in the pre-market session on Tuesday after several brokerages lowered their price target on the stock after the company shared disappointing news about its drug pipeline.

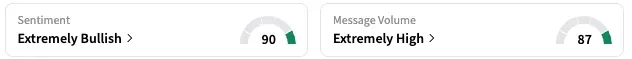

On Stocktwits, retail sentiment around VRTX jumped from ‘neutral’ to ‘extremely bullish’ over the past 24 hours, while message volume rose from ‘normal’ to ‘extremely high’ levels. According to Stocktwits data, retail chatter around the stock jumped 5300% in the past 24 hours.

A Stocktwits user termed the stock slump an overreaction and noted that it is, instead, a buying opportunity.

Another highlighted the company’s upbeat Q2 earnings.

Vertex on Monday said that treatment with its investigational pain drug VX-993 did not result in statistically significant improvement in acute pain after bunionectomy surgery in a mid-stage study. Based on the results, the company said that it will not progress the drug as a solo treatment for acute pain anymore.

The company also said that it would not advance its FDA-approved pain medication Journavx into a late-stage trial for studying its impact in lumbosacral radiculopathy (LSR), a condition where nerve roots in the lower back are compressed or irritated, causing pain and other neurological symptoms.

Instead, the company said it would prioritize testing of Journavx in treating diabetic peripheral neuropathy or pain caused by nerve damage caused by diabetes. The decision was made following discussion with the FDA, it said.

The updates spurred multiple price target cuts:

- Morgan Stanley lowered its price target on Vertex to $439 from $460 and kept an ‘Equal Weight’ rating on the shares.

Pipeline setbacks, including Journavx not advancing into a late-stage trial in lumbosacral radiculopathy (LSR) and pain signal inhibitor VX-993 being found to be not differentiated in acute pain, likely will be a focus and drive weakness in the stock despite Vertex having posted a Q2 beat, the analyst told investors. - H.C. Wainwright lowered the firm's price target on Vertex Pharmaceuticals to $478 from $550 to reflect the company’s updates on its pipeline. The firm, however, kept a ‘Buy’ rating on the shares.

- BMO Capital, meanwhile, lowered the firm's price target on Vertex Pharmaceuticals to $530 from $557 and kept an ‘Outperform’ rating on the shares. The company's "impressive" commercial quarter was largely offset by the portfolio updates, the analyst told investors in a research note.

For the second quarter, Vertex reported total revenue of $2.96 billion, a 12% increase compared to Q2 2024, and above an analyst estimate of $2.91 billion, according to data from Fiscal AI.

Adjusted and diluted earnings per share came in at $4.52, above an expected $4.25.

VRTX stock is up by 17% this year but down by about 1% over the past 12 months.

Read also: Tesla Germany Sales Slump 55% In July: Retail Believes Stock Is Not Affected By Bad News Anymore

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)