Advertisement|Remove ads.

Morgan Stanley Sees Vertiv Benefiting From $4.8B Nvidia GPU Cooling Opportunity: Is Retail Cued In?

The relentless march of AI, powered largely by Nvidia’s GPUs, is creating an unexpected goldmine: data center cooling. Morgan Stanley believes this could be a $4.8 billion market by 2027, and one U.S. company could stand to gain significantly. But are retail investors already aware of this opportunity?

Vertiv Holdings Inc. (VRT), the sole U.S.-listed stock among potential beneficiaries listed by Morgan Stanley, has been an exceptional performer, fueled by the increasing demand for data center infrastructure.

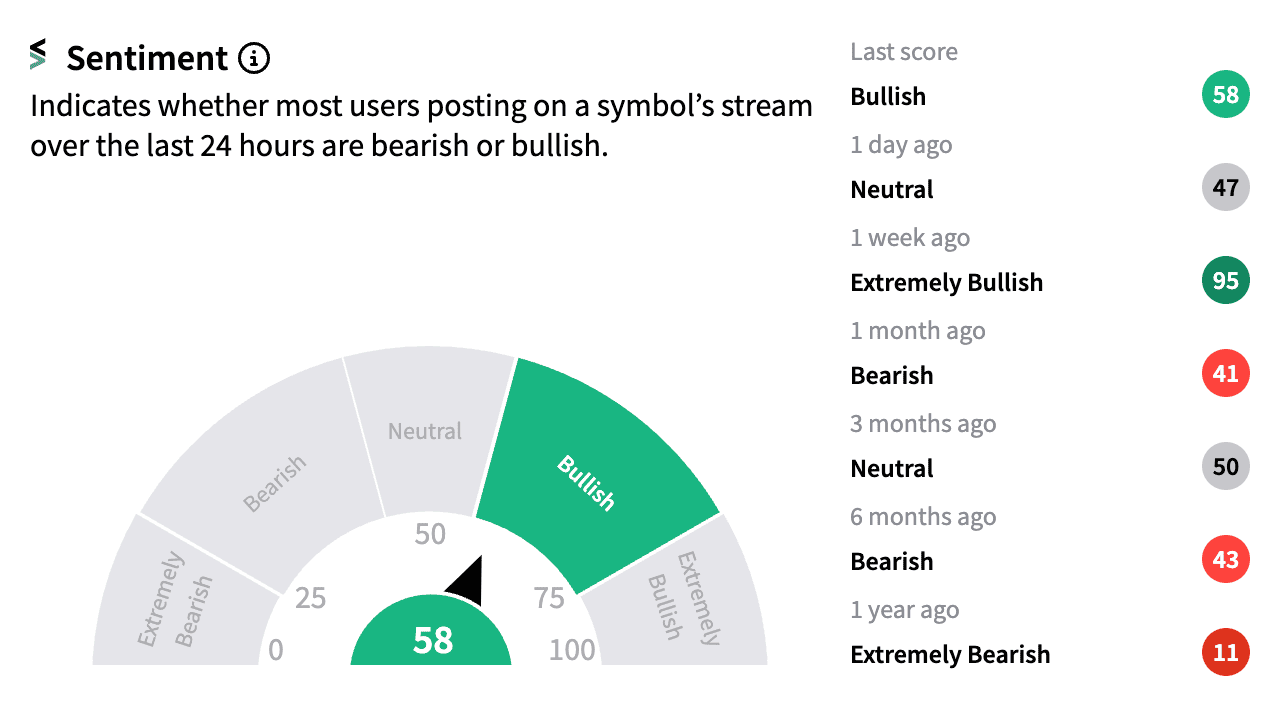

Stocktwits data indicates retail investors have been cautiously optimistic to bullish on VRT for the past week, with high message volume surrounding the stock.

CEO David Menzel’s AI-focused bullish outlook after strong Q2 earnings last month, combined with Nvidia boss Jensen Huang’s endorsement back in March, has solidified Vertiv’s position as a key player.

The stock is up over 72% this year, adding to 2023’s whopping 252% surge. However, the company's lofty price-to-earnings (P/E) ratio of 61.21 — way higher than that of peers Trane and Eaton — raises valuation concerns among certain investors, according to an opinion piece on Bloomberg.

Some in the retail segment remain confident. “I see genuine untapped potential in this company. It showed resilience in the sell-off maelstrom [of the] last couple of weeks and I’m glad I held and will continue to hold,” Stocktwits user Hal_Nas posted.

While Vertiv is in the spotlight, Morgan Stanley listed Taiwan-based Delta Electronics as its top pick and added that Schneider Electric and AVC are also well-positioned.

As the AI revolution intensifies, so too will the cooling challenge, making this a space worth watching for retail investors.

Image via Vecteezy

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)