Advertisement|Remove ads.

Viasat Stock Declines On Q3 Earnings, Revenue Miss: Retail Sentiment Remains Bearish

Shares of Viasat Inc. (VSAT) declined over 3% in pre-market trade on Friday as the company’s third-quarter results missed Wall Street estimates.

Viasat posted revenue of $1.12 billion during the third quarter, missing consensus estimates of $1.13 billion, according to Stocktwits data.

The company also missed estimates on the earnings front – it posted a net loss per share of $1.23, higher than an estimated loss of $0.82 per share.

Its overall net loss ballooned to $158 million during the third quarter from $124 million during the same period last year. Viasat noted that this was due to a loss on the extinguishment of Inmarsat’s 2026 senior secured notes.

Further, Viasat also posted a 6% decline in revenue from its core communication services business due to a fall in revenue from maritime services.

It also received awards of $1.1 billion during the quarter, down 12% year-on-year.

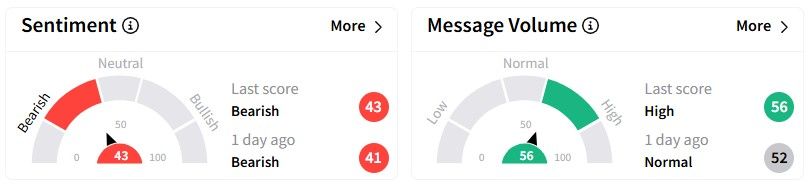

Retail sentiment on Stocktwits around the Viasat stock stayed in the ‘bearish’ (43/100) territory, although message volume witnessed an increase.

One user posted on the platform that they’ve sold most of their position in the Viasat stock, reflecting a pessimistic outlook.

Another user thinks the company is in “trouble.”

Viasat’s share price has fallen more than 46% over the past six months and nearly 49% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)