Advertisement|Remove ads.

Viking Shares Pop After CEO Says Biz Insulated From Market Volatility, Cruises Mostly Booked For Whole Year

Viking Holdings Ltd (VIK) shares rose 4% on Tuesday after its chief executive said the cruise operator was mostly booked to capacity this year and did not see an impact from stock market volatility on the business.

"We have a strong marketing position and when things get tough, we market more," CEO Torstein Hagen said in an interview to CNBC.

He added Viking was 88% booked for 2025 as of February, and did not expect cancellations.

California-headquartered Viking was listed in May last year, when it raised $1.5 billion in an initial public offering.

Since then, its shares have gained consistently, hitting an all-time high in February and lifting the company's market cap to about $22.8 billion.

Cruise operators and the broader travel sector have not been impacted as significantly as retailers or tech companies, although they've flagged risks.

Companies are preparing for ship purchases to become expensive, while a stronger dollar and pricier hotel stays would likely deter international travellers coming to the U.S.

Last month, Jefferies initiated coverage on the company with an 'Overweight' rating and a $45 price target. That compares to analysts' average price target of $50.94, according to Koyfin data.

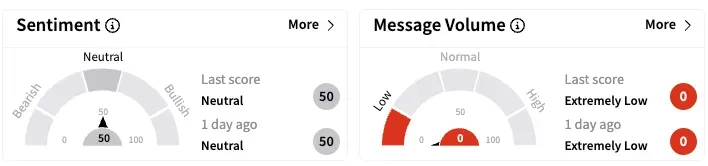

On Stocktwits, retail sentiment for VIK was neutral.

One user noted that the business and stock performance was healthy.

VIK shares are down about 29% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)