Advertisement|Remove ads.

Verizon Stock Slides Pre-Market As Q3 Revenue Disappoints: But Retail's Happy Overall

Verizon Communications Inc. ($VZ) shares dropped over 3% pre-market Tuesday following mixed Q3 results, even as retail investors’ mood remained upbeat.

The company posted net income of $3.4 billion, or 78 cents per share, down from $4.9 billion in the same quarter last year, as workforce-reduction charges impacted the bottom line.

But adjusted earnings of $1.19 per share slightly beat analysts’ expectations of $1.18 per share.

However, revenue came in flat at $33.3 billion, just below the projected $33.4 billion, disappointing investors.

Bloomberg Intelligence analysts pointed to a downturn in equipment sales, citing “a lack of compelling new hardware features from smartphone makers,” leading to lower customer churn and upgrades.

CEO Hans Vestberg also recently noted that customers, who previously upgraded phones every 12 months, are now holding onto devices for over 40 months.

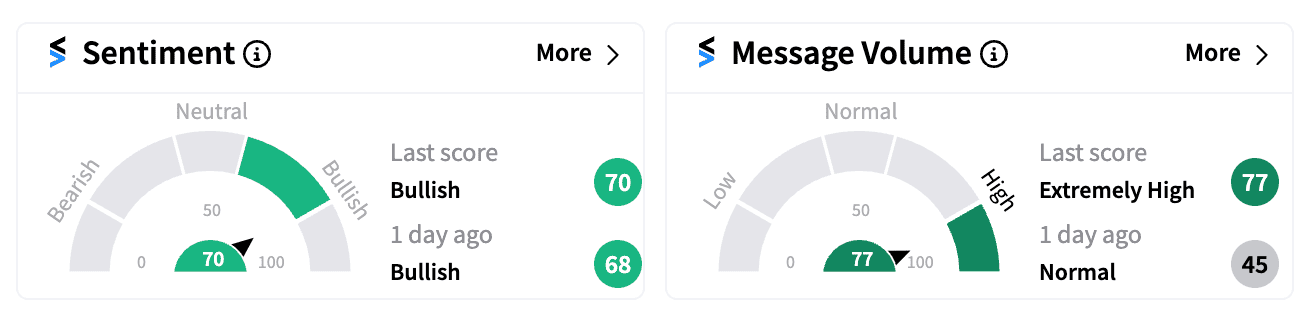

Despite the market reaction, retail sentiment on Stocktwits was more positive, with a ‘bullish’ score as of 8:45 a.m. ET.

Many users expressed confidence in Verizon’s long-term value, bolstered by its 6% dividend yield.

Verizon saw 239,000 retail postpaid phone net additions, beating Wall Street’s estimate of 221,500.

Its consumer business added 81,000 retail postpaid phone subscribers, recovering from last year’s losses.

Additionally, 18,000 postpaid additions came from its second-number program, which allows customers to separate communication streams.

While VZ stock has risen more than 12% YTD, it lags behind the Communication Services Select Sector SPDR Fund ($XLC) and the S&P 500, both up over 25% and 23%, respectively.

For updates and corrections email newsroom@stocktwits.com

Read next: 3M Stock Rises Pre-Market After Earnings Beat, Retail Gets More Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2211638677_jpg_6d639f282d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_chart_down_94a394e31b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_491310329_jpg_e91ab647c0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_asml_logo_resized_a8ba5209aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_logo_headquarters_original_jpg_d9fbb245f9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)