Advertisement|Remove ads.

Waaree Energies Rides Solar Boom: Q1 Profit Jumps 93%, SEBI RAs See Upside Ahead

Waaree Energies shares rose 3% on Tuesday after the company delivered a blockbuster June quarter (Q1FY26) earnings, with strong growth on all fronts.

Profits surged 93% to ₹773 crore and sales rose 30% to ₹4,426 crore. Operating Profit soared 81%, and margins expanded from 16% to 23%. The growth was driven by a rise in solar photovoltaic (PV) module sales, with the company achieving its highest-ever quarterly module production of 2.3 GW in Q1 FY26.

In Q1 FY26, Waaree Energies' revenue from solar PV modules increased to ₹3,872.35 crore. The Engineering, Procurement, and Construction (EPC) segment saw a significant year-over-year jump of 160.50%, reaching ₹589.27 crore.

SEBI-registered analyst True North Capital added that the company has continued to ramp up its cell production steadily. And that they are on track to commission a 1.6 GW module capacity in Texas (USA), and a 3.2 GW module capacity in Chikhli (Gujarat). The board has approved an additional ₹2,754 crore of capital expenditure for plants in Gujarat and Maharashtra.

On the technical charts, analyst Sunila Kotak said that Waaree Energies stock was trading around its recent highs. He identified ₹3,300-₹3,350 as a strong supply zone.

Its Relative STrength Index (RSI) stands below 60, indicating that the momentum remains sideways on the daily chart. On the upside, the stock faces a significant resistance. On the downside, he sees ₹3,100-₹3,130 as a strong demand zone for the stock.

Analyst Prabhat Mittal advised keeping a stop loss of ₹3,050, with possible targets of ₹3,400 and ₹3,500 in the near term.

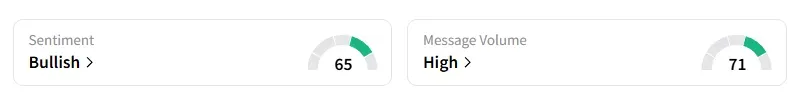

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago on this counter amid 'high' message volumes.

Waaree Energies shares have risen 11% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)