Advertisement|Remove ads.

Wall Street Grows Bitter On Starbucks As Goldman Sachs Says CEO Niccol Has Yet To Deliver A Big Turnaround

Goldman Sachs has lowered its rating and price target on Starbucks (SBUX) shares, as sentiment among analysts grows increasingly cautious about the coffee chain's business and the slow progress of its turnaround efforts.

The investment firm lowered its rating to 'Neutral' from 'Buy' and price target to $85 from $103, according to The Fly.

Goldman Sachs anticipates a slower recovery in the home market of North America, citing data that shows a gradual loss of brand momentum.

While CEO Brian Niccol has implemented changes, the brokerage said it is yet to see a significant improvement in net purchase intentions, with most key performance drivers still declining as of March, according to an investor note.

Goldman Sachs's view comes alongside price target cuts from several Wall Street analysts, including JPMorgan and TD Cowen, following Starbucks' second quarter results earlier this week.

After four quarters of de-growth, sales rose 2% to $8.76 billion for the quarter ended March 30. The figure was, however, lower than analyst expectations of $8.82 billion from LSEG/Reuters.

Adjusted profit declined for a fifth straight quarter to $0.41, also below the consensus estimate of $0.48.

The company's margin and earnings disappointed, which will pressure the stock's valuation, Barclays told investors in a research note, according to The Fly.

TD Cowen said the negative stock reaction after earnings and the need to invest in labor over equipment to improve speed are a step backward in the recovery.

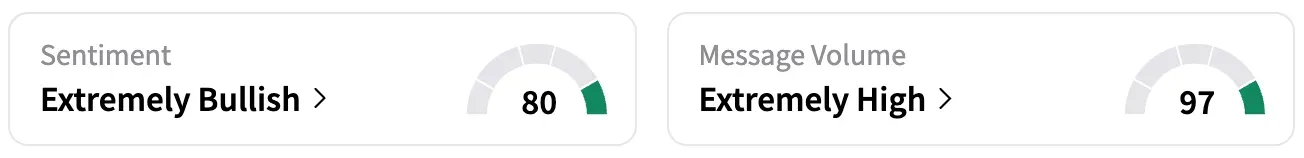

However, retail sentiment on Stocktwits turned 'extremely bullish' from 'extremely bearish' a day earlier.

A user expressed displeasure with the new CEO and said he "skirts questions."

Starbucks shares are down 12.3% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2225993084_jpg_3889c04879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259461476_jpg_bc073e334e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_treasury_yields_jpg_074c6369d6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228875521_jpg_75c09da7fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)