Advertisement|Remove ads.

Wall Street Has Mixed Opinions On Future Of Arvinas’ Investigational Drug: Retail’s Got A Cautious Approach

Shares of Arvinas Inc. (ARVN) fell 4% on Thursday as Wall Street sounded contradicting opinions on the future of its investigational drug Vepdegestrant.

Wells Fargo believes Pfizer's (PFE) waning interest in Vepdegestrant could lead to Arvinas getting it back, but given where the stock is trading, this seems priced in. The firm noted that Arvinas won't launch the drug solo and added that with runway to the second half of 2028, focus shifts to its early-stage pipeline, which can create value.

Arvinas announced a global collaboration with Pfizer for the co-development and co-commercialization of Vepdegestrant in July 2021. Wells lowered its price target on Arvinas to $16 from $19 while keeping an ‘Overweight’ rating on the shares.

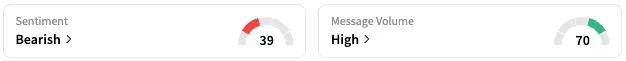

On Stocktwits, retail sentiment around Arvinas fell from ‘neutral’ to ‘bearish’ territory over the past 24 hours, while message volume rose from ‘normal’ to ‘high’ levels.

H.C. Wainwright, however, raised its price target on Arvinas to $24 from $18 while keeping a ‘Buy’ rating on the shares. The firm sees a path forward for Vepdegestrant and cited the company's pipeline development and progress for the target increase.

Arvinas and its partner Pfizer submitted a new drug application for Vepdegestrant to the U.S. Food and Drug Administration in June for the treatment of certain types of advanced or metastatic breast cancer previously treated with endocrine-based therapy.

The application was based on data from a late-stage trial that evaluated Vepdegestrant versus the popular breast cancer medicine Fulvestrant. While the trial demonstrated improvement in median progression-free survival (PFS) compared to Fulvestrant, it did not reach statistical significance.

In the second quarter, Arvinas recorded a revenue of $22.4 million, down from $76.5 million in the corresponding quarter of 2024. The company pegged the drop in part to a fall in revenue from the agreement with Pfizer related to the removal of certain late-stage combination trials of Vepdegestrant with Pfizer’s investigational drugs from the development plan.

ARVN stock is down by 68% this year and by about 75% over the past 12 months.

Read also: Toyota Warns Higher US Tariff Impact For FY26: Retail Sees No Reason To Cheer

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)