Advertisement|Remove ads.

Wall Street Raises NetApp Targets But Flags Margin Worries: Retail In Neutral Ground

NetApp Inc. (NTAP) received a slew of price target hikes from Wall Street analysts following its better-than-expected first-quarter (Q1) fiscal year 2026 earnings, with some firms highlighting near-term margin pressure.

The company reported Q1 revenue of $1.56 billion and an adjusted earnings per share (EPS) of $1.55, both surpassing the analysts’ consensus estimate of $1.53 billion and $1.54, respectively, as per Fiscal AI data.

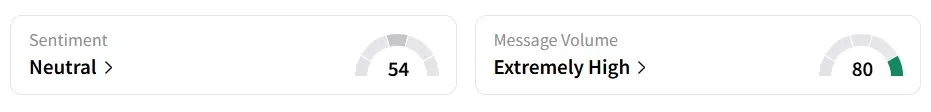

NetApp stock traded over 2% higher on Thursday. On Stocktwits, retail sentiment around the stock shifted to ‘neutral’ from ‘extremely bullish’ territory the previous day. Message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock experienced a 2,800% surge in user message count over 24 hours as of Thursday morning.

Barclays has increased its price target on NetApp stock to $125 from $117, maintaining an ‘Overweight’ rating, according to TheFly. The firm pointed to underwhelming product gross margins and continued softness in its European and U.S. federal businesses as areas of concern.

Barclays anticipates product margins will improve, while cloud software is expected to remain a strong segment.

Meanwhile, UBS also raised its target to $114 from $108 with a ‘Neutral’ rating, noting that demand is expected to pick up in the second half of the fiscal year.

Morgan Stanley analyst Erik Woodring moved the firm’s target slightly higher to $117 from $115, and reiterated an ‘Equal Weight’ rating. Woodring acknowledged that NetApp's performance lagged behind competitors like Pure Storage Inc. (PSTG), but stated that the results were mostly in line with expectations.

NetAp stock has declined 0.1% in 2025 and more than 12% over the past 12 months.

Also See: Why Did Mobix Labs’ Stock Surge 22% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)