Advertisement|Remove ads.

Wall Street Sees Strong Q2 For Nvidia Amid AI Spending Rise: Retail Gets Ready For Earnings

Nvidia Corp. (NVDA) received bullish signals from Wall Street analysts as it heads into its fiscal second-quarter (Q2) earnings expected after Wednesday’s closing bell.

According to a CNBC report, JPMorgan’s Harlan Sur emphasized that cloud giants and hyperscalers have boosted capex forecasts for Q2 2025, an indicator of improving AI fundamentals.

“We believe near-term AI fundamentals are strong, driven by strong hyperscale capex spending. This trend is evident in the upward revision in capex during the Q2 2025 earnings season by the cloud/ hyperscale companies, and the strong results/guidance telegraphed by other AI beneficiaries (e.g., MTSI, ALAB, AMD).”

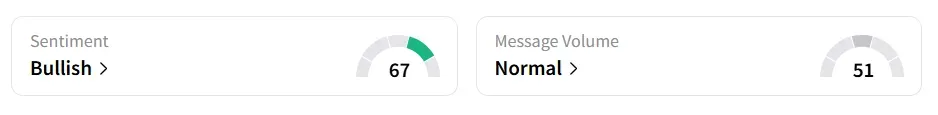

Nvidia stock traded over 1% higher on Monday afternoon. On Stocktwits, retail sentiment toward the stock remained in ‘bullish’ territory amid ‘normal’ message volume levels.

The stock experienced a 115% surge in user message count in 24 hours. A Stocktwits user sounded bullish on the stock.

According to the CNBC report, Goldman Sachs projected Q2 revenue of between $46 billion and $47 billion, increasing to a range of $53 billion to $54 billion for Q3 as Nvidia ramps up shipments of GB200 and prepares for GB300 launches.

Koyfin data shows 58 analysts rate Nvidia a ‘strong buy’ or ‘buy,’ with only six at ‘hold’ and just one at ‘sell.’ The stock has gained over 35% year-to-date and over 43% in the last 12 months.

The chip giant sees Q2 revenue of $45 billion, plus or minus 2%. As per Fiscal AI data, analysts expect Nvidia’s Q2 revenue to be $45.8 billion and earnings per share (EPS) to hit $1.00.

Also See: Elon Musk’s xAI Accuses Apple, OpenAI Of Anti‑Competitive Practice: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)