Advertisement|Remove ads.

Wall Street Sees Pfizer's Weight-Loss Pill Exit As A Win For 2 Smaller Biotech Firms: Retail Turns Bullish

Pfizer Inc.'s (PFE) decision to halt the development of its oral GLP-1 candidate due to a potential liver toxicity issue could pose tailwinds for smaller biotech rivals, according to Wall Street analysts.

According to The Fly, JPMorgan thinks Pfizer's scrapping of its danuglipron program opens the door for Structure Therapeutics’ (GPCR)GSBR-1290 (aleniglipron) to become the second small molecule oral GLP-1 to reach the market.

It also makes Viking Therapeutics' (VKTX) an "even more attractive partnership candidate," the analyst said.

Meanwhile, BTIG also flagged Viking as a key beneficiary, reiterating its 'Buy' rating and $125 price target, implying a 400% upside from the last close.

The research firm pointed to Viking's "competitive" oral candidate VK2735, currently in Phase 2 trials, with data expected in the second half of 2025.

A Phase 3 study for the injectable form is also set to begin in the second quarter.

Media reports suggest Pfizer could now look to external assets. BTIG said it remains focused on Viking's "compelling pipeline and data" regardless of Pfizer's next steps.

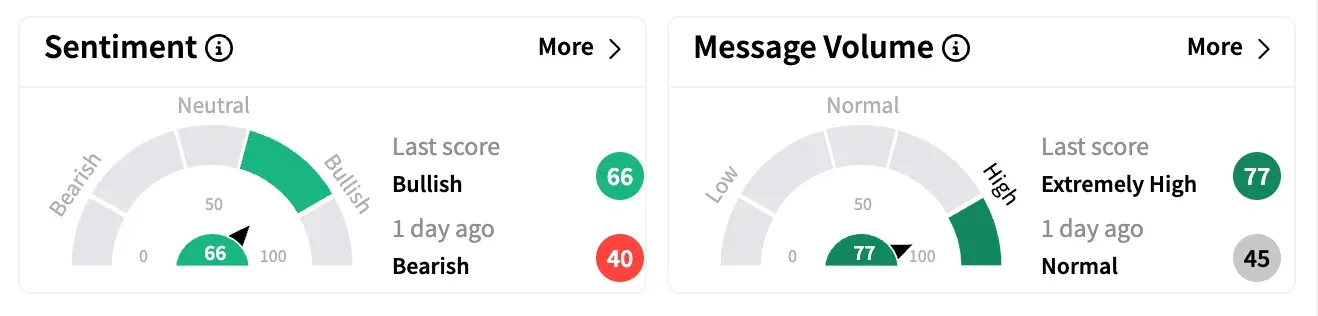

Retail sentiment for Viking Therapeutics turned 'bullish' late Monday from 'bearish' a day ago, accompanied by an 8,220% surge in message volume.

One user thought Viking's stock "should be up 30-40%" as it has the "best in class oral GLP-1 now."

Another watcher speculated that Pfizer could likely buy Viking Therapeutics following the news.

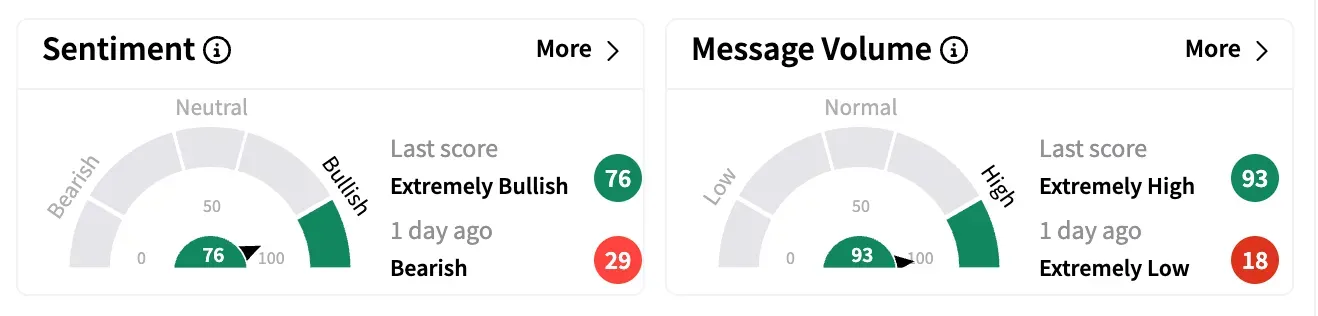

Structure Therapeutics, meanwhile, saw its sentiment meter jump into 'extremely bullish' levels from 'bearish' a day ago.

A bullish user said the company's aleniglipron "is going to be best in class" among GLP-1 oral pills, and CEO Ray Stevens "knows it's an easy winner and big money."

Structure's stock is down over 30% year to date, while Viking's has lost nearly 40%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)