Advertisement|Remove ads.

NVDA vs. AAPL vs. GOOGL vs. MSFT: Which Megacap Will End 2025 As Most Valued Company? Retail Backs Nvidia Despite Recent Headwinds

- Portfolio moves by fund managers in the third quarter show that Nvidia might be falling out of favor.

- Nvidia’s market capitalization topped $5 trillion in late October, the first company ever to achieve the feat.

- Since then, it has retreated below the level amid rising AI skepticism.

The megacap tech stocks, which make up all but one of the Magnificent Seven group, have shown signs of fatigue after their extended run since late 2022, which also marked the previous bear-market bottom.

The Roundhill Magnificent Seven ETF (MAGS), an exchange-traded fund (ETF) that tracks the Mag 7 stocks, is up about 22% for the year but has lost 3% since Oct. 29. The near-term weakness came amid skepticism regarding an artificial intelligence (AI) bubble and doubts raised by prominent voices on the Street regarding the reckless spending on AI infrastructure by hyperscalers.

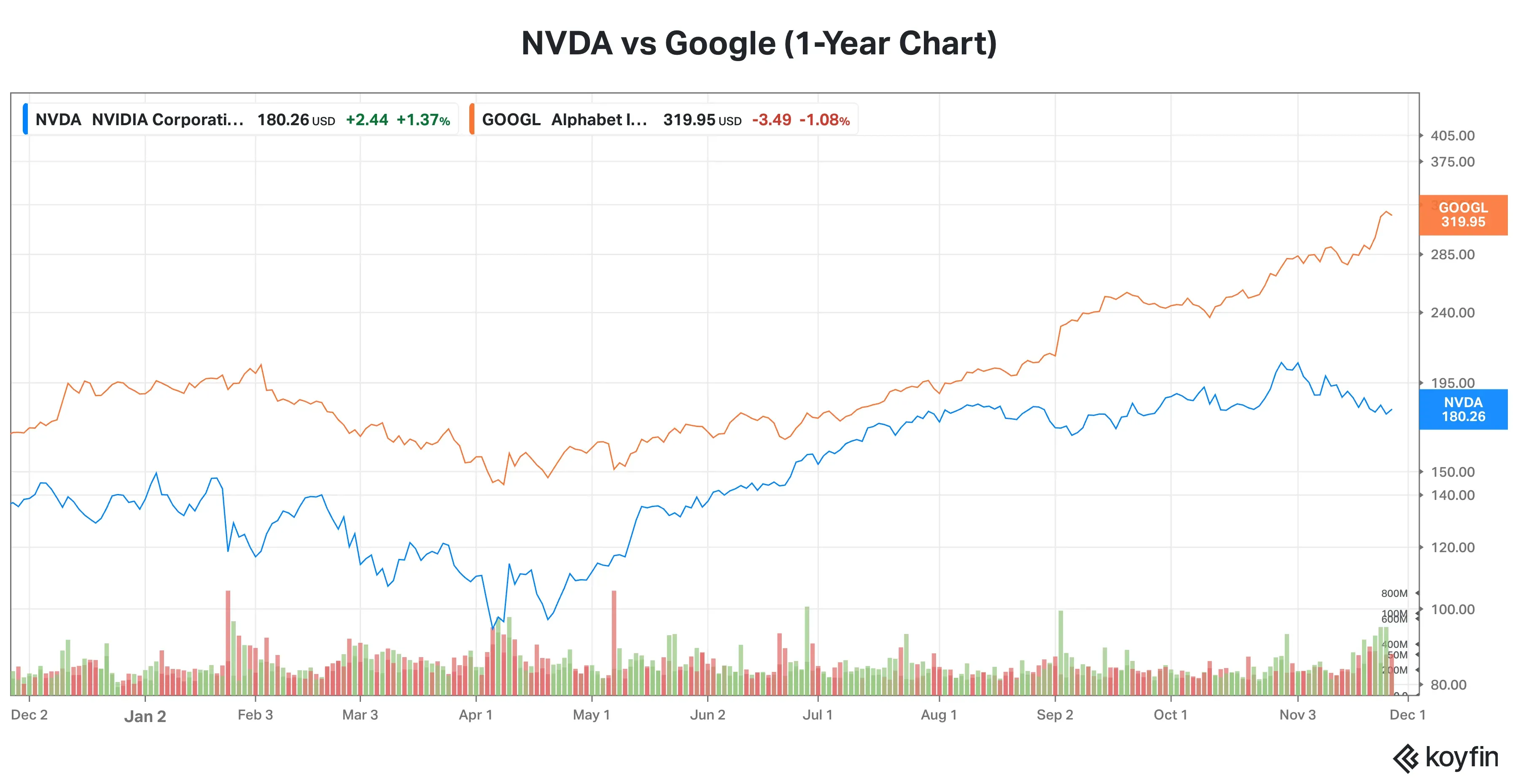

Nvidia-Google Diverge

AI poster child Nvidia’s stock was running red hot until these worries surfaced, as investors were mostly convinced about hyperscalers’ insatiable demand for its high-performance computing chips. Nvidia’s market capitalization topped $5 trillion in late October, the first company ever to achieve the feat. Shortly after the Jensen Huang-led company’s valuation fell below the mark, only to recover and go past it for a second time.

Nvidia’s stay above the $5 trillion valuation zone proved short-lived amid the AI pessimism going around. The company came under criticism from “Big Short” investor Michael Burry, who questioned its stock-based compensation accounting and the asset-life assumptions for its data center assets.

Around the same time, Alphabet’s stock began to pick up momentum, thanks to a raft of factors, including market share gains for its Gemini 3 model, quantum computing breakthroughs, Warren Buffett’s Berkshire Hathaway initiating a position, and, most recently, rumors of the company selling its AI chips to third parties.

Source: Koyfin

Source: Koyfin

Retail Unfazed By Nvidia Volatility

A Stocktwits poll asking users, “Which company ends 2025 with the largest market cap?” found that retail traders reposed their confidence in Nvidia and weren’t unduly worried about the recent rise in skepticism.

The poll, posted Tuesday evening and set to end in a day, has received responses from 13,700 users. An overwhelming majority of (59%) picked Nvidia, followed by Google (27%), Apple (8%), and Microsoft (6%). Incidentally, users were asked to pick from a list comprising these four stocks.

Commenting on the poll timeline, one user said Google, however, could give Nvidia a run for its money.

Portfolio changes by fund managers in the third quarter show that Nvidia might be falling out of favor, with Burry taking a short position in the company. Masayoshi Son’s SoftBank and Peter Thiel’s macro fund exited Nvidia during the third quarter.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Google Effect? Broadcom Stock Surges To Fresh Highs, Erasing Losses From Tech Sell-Off

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)