Advertisement|Remove ads.

Barrick Stock Hits 14-Year High After Resolving Mali Dispute — Is There More Upside?

- The Canadian miner said earlier this week that all charges brought against Barrick, its affiliates, and employees will be dropped.

- BMO Capital Markets analysts reportedly noted that if Barrick could restart production swiftly, the mine’s output could reach 670,000 ounces next year, generating $1.5 billion in operating cash flow.

- TD Cowen analysts noted that Barrick stock continues to trade at a discount to peers, which the brokerage considers unwarranted.

Barrick Mining’s (B) U.S. shares have advanced by more than 12% this week, outperforming its peers, after the miner resolved a two-year dispute with the government of Mali that had halted operations and triggered arrests.

The Canadian miner’s stock closed up at $40.98, the highest since late November 2011.

Two-Year-Old Mali Dispute Finally Comes To An End

The tussle began after Mali demanded higher royalties from Barrick, which the company refused to pay. In response, the military junta in the West African nation arrested four Barrick employees, issued an arrest warrant for former CEO Mark Bristow, and seized the Loulo and Gounkoto mines.

The Canadian miner said earlier this week that all charges brought against Barrick, its affiliates, and employees will be dropped, and the legal steps to release the four detained Barrick employees will be undertaken. The company also said that Mali will hand back the mines to Barrick, and the miner will withdraw the arbitration claims currently pending in international courts.

Separately, Bloomberg News reported that the company has agreed to a 244 billion CFA francs ($430 million) settlement with Mali to resolve the dispute. Under the settlement, Barrick would pay 144 billion CFA francs within six days of signing the agreement with Mali’s government, the report stated. The firm added that 50 billion CFA francs will come via VAT-credit offsets, while an installment of the same size was already paid in 2024.

BMO Capital Markets analysts reportedly noted that if Barrick could restart production swiftly, the mine’s output could reach 670,000 ounces next year, generating $1.5 billion in operating cash flow.

What Are Stocktwits Users Thinking?

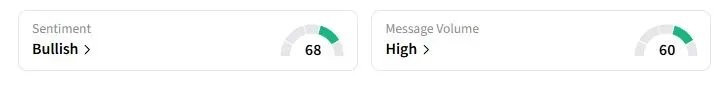

Retail sentiment on Stocktwits about Barrick was in the ‘bullish’ territory, compared with ‘neutral’ a week ago.

Stock Still Trades At A Discount?

According to investing.com, TD Cowen analysts noted that Barrick stock continues to trade at a discount to peers, which the brokerage considers unwarranted given the strategic value and upside of the company’s Fourmile discovery and Nevada operations generally. The Fourmile project in Nevada is one of the most significant gold discoveries in recent years.

The brokerage also noted that the current valuation does not fully reflect Barrick’s potential, as the company moves through its leadership reshuffle and potentially refocuses its strategic priorities. Earlier this month, the Financial Times revealed that Elliott has become one of the top 10 shareholders in Barrick, implying an investment of at least $700 million.

While Barrick stock has jumped nearly 160% this year amid the rally in bullion prices, its gains still lag those of some peers, including Kinross Gold, which has surged 192%.

Also See: Cramer Predicts A ‘Monstrous’ 2026 For Boeing — Retail Traders Are Starting To Agree

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)