Advertisement|Remove ads.

Waller's Odds For Fed Chair Nomination Surge After The Fed Governor's Dovish Comments On Rate Cuts

- Waller stated that he expects inflation to cool and that he has not seen any evidence that inflation expectations are taking off.

- However, he noted that the labor market is not seeing a dramatic decline, so the Fed could ease policy at a moderate pace.

- The Fed Chair candidate added that he thinks interest rates are still 50 to 100 basis points off the neutral point.

Christopher Waller’s odds of being nominated by President Donald Trump as the next Fed Chair soared on Wednesday after the Federal Reserve Governor’s dovish comments on the central bank’s monetary policy stance.

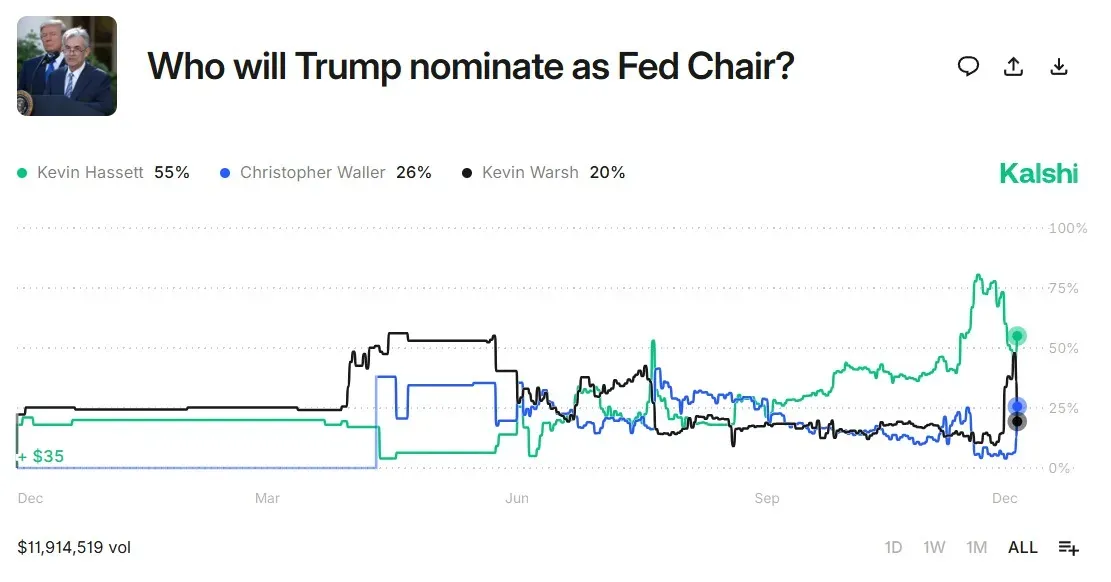

Waller now has a 26% chance of being nominated by President Trump for the Fed Chair position, up from 8% a day ago, while White House National Economic Council Director Hassett leads with a 55% chance. Former Federal Reserve Governor Kevin Warsh is now in the third spot, with a 20% chance.

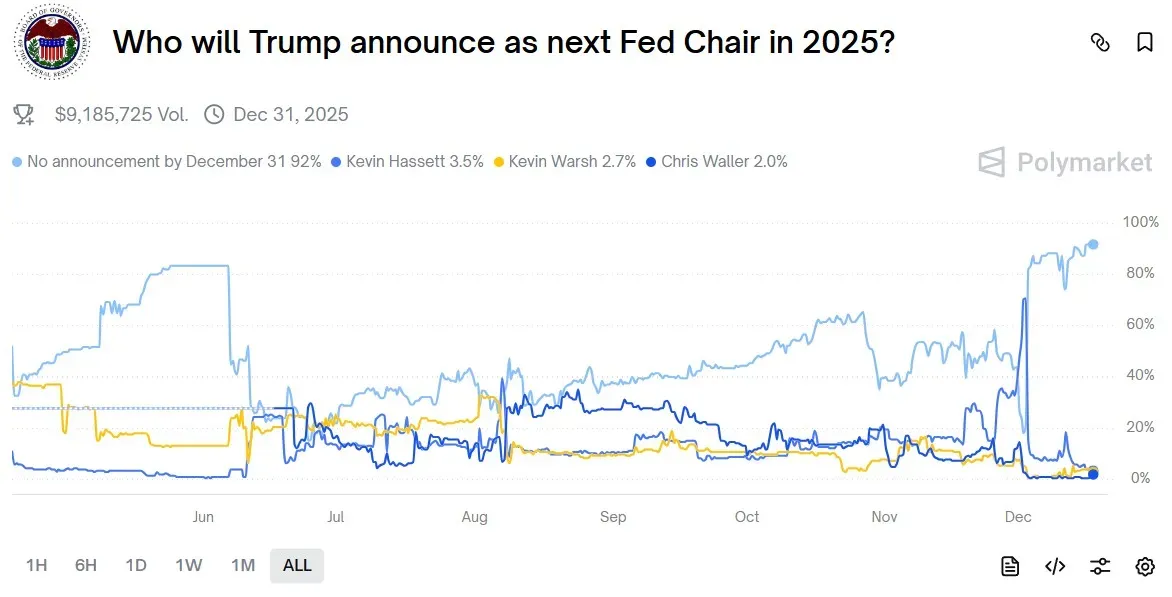

Polymarket users think there is a 92% chance that President Trump won’t announce the Fed Chair nominee by Dec. 31, 2025. Hassett has a 3.5% chance, Warsh has a 2.7% probability, while Waller is in third place with a 2% chance, according to Polymarket data.

Dovish Outlook

Speaking at the Yale School of Management CEO Summit in New York, Waller said he expects inflation to cool and that he has not seen any evidence that inflation expectations are taking off. “The labor market is telling us that we should continue cutting the rates, and that’s kinda my view about things,” he said.

However, he noted that the labor market is not seeing a dramatic decline, so the Fed could ease policy at a moderate pace. “I don’t think we have to do anything dramatic,” he added.

Waller also said that his view of the neutral rate is below the midpoint of 3%. “I still think we’re probably, you know, maybe we’re 50 to 100 basis points off of neutral,” he stated, while adding that there is still some room for further cuts.

Fed’s Independence

Waller also emphasized the importance of the Fed’s independence. “I spent 20 years of my life working on central bank independence and why it was important. I have a long paper trail on this,” he said.

Meanwhile, U.S. equities were mixed in Wednesday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.01%, the Invesco QQQ Trust ETF (QQQ) declined 0.23%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) gained 0.43%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down by 0.05% at the time of writing.

Also See: UDMY, COUR Stocks Surge After Online Learning Rivals Announce AI-Focused Merger

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2261643084_jpg_6360b6a821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Quantum_Computing_jpg_8d3aa87e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_capitol_building_OG_jpg_388637a98c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)