Advertisement|Remove ads.

Warren Buffett’s Last Day As CEO Of Berkshire Hathaway Could Leave A Question Or Two For Investors, Especially After Todd Combs’ Exit

- In late June, the Oracle of Omaha announced that he is stepping down as the CEO of Berkshire.

- Berkshire’s equity holdings have long mirrored Buffett’s value-oriented, long-term investing philosophy.

- Buffett has been Berkshire’s chief executive officer since 1965 and played a key role in moving the company into insurance.

As Warren Buffett officially steps down as the chief executive of Berkshire Hathaway Inc. (BRK.A, BRK.B) on Wednesday, the future of its enormous publicly traded stock portfolio will be a key topic of discussion among investors.

In late June, the Oracle of Omaha announced that he is stepping down as the CEO of Berkshire. Greg Abel, who will assume the CEO role on January 1, now faces the complex task of overseeing the company’s roughly $300 billion equity portfolio.

Berkshire’s equity holdings have long mirrored Buffett’s value-oriented, long-term investing philosophy.

Concerns have risen after Todd Combs, one of the two long-serving investment managers considered a possible successor to Buffett, left the company to join JPMorgan Chase & Co. (JPM).

According to a CNBC report, CFRA’s Cathy Seifert said that in the short term, Abel is expected to oversee the equity portfolio with help from Ted Weschler, one of Berkshire’s remaining investment managers. However, Seifert warned that this arrangement could face more scrutiny if the team of managers shrinks further.

In his farewell letter in November, Buffet said, “Berkshire’s businesses have moderately better-than-average prospects, led by a few non-correlated and sizable gems. However, a decade or two from now, there will be many companies that have done better than Berkshire; our size takes its toll.”

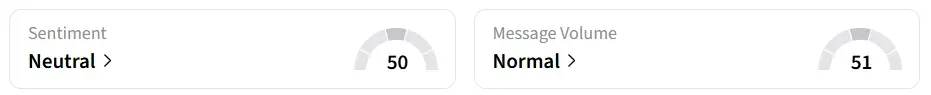

Berkshire Hathaway Class B stock inched 0.1% higher in Wednesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘normal’ message volume levels.

Buffet’s Legacy

Buffett has been Berkshire’s chief executive officer since 1965 and played a key role in moving the company into insurance. By 1985, he had steered Berkshire away from its original textile business.

Berkshire’s market capitalization stood at $1.09 trillion at the end of Tuesday's trading. According to Companiesmarketcap data, it was the eleventh most valuable company in the world by market capitalization.

In October, the company announced that it had approved changes to its bylaws, effective immediately, to split the positions of Chairman of the Board and CEO. It noted that Buffett would remain in his role as chairman.According to CNBC, analysts suggest Berkshire might pivot from concentrated stock selection toward a more diversified, benchmark-oriented approach.

BRK.B stock has gained over 11% year-to-date.

Also See: Nvidia’s China Orders Are Surging – And Retail Believes Price Targets Will Follow

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_stock_jpg_770e12377f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205716060_jpg_b54d4e2d13.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)