Advertisement|Remove ads.

Nvidia’s China Orders Are Surging – And Retail Believes Price Targets Will Follow

- Nvidia has reportedly turned to Taiwan Semiconductor Manufacturing Co. (TSM) to expand output using its 4-nanometer process.

- It has settled on offering both standalone H200 chips and GH200 Grace Hopper superchips to Chinese buyers.

- Major internet companies are driving most of the demand.

Nvidia Corp. (NVDA) is reportedly reshaping its production plans, hustling to secure more capacity for its H200 artificial intelligence processors due to surging demand from China.

According to a Reuters report, Chinese firms have lined up requests for more than 2 million H200 units slated for delivery in 2026, far more than the roughly 700,000 chips Nvidia currently has.

Manufacturing Push At TSMC

To bridge the gap, Nvidia has turned to Taiwan Semiconductor Manufacturing Co. (TSM) to expand output using its 4-nanometer process. According to the report, the chipmaker has asked TSMC to begin additional production, with work likely to start in the second quarter of 2026.

Nvidia has settled on offering both standalone H200 chips and GH200 Grace Hopper superchips to Chinese buyers, stated the report. Nvidia stock inched 0.5% higher in Monday’s premarket.

In early December, President Trump announced that shipments of the H200 chip could proceed, provided a 25% sales charge is paid. The H200 is considered the second-most powerful Nvidia chip approved for export and remains the highest-level graphics processor permitted under current U.S. regulations.

Chinese Tech Giants Lead Orders

Major internet companies are driving most of the demand, seeing the H200 as a substantial leap beyond alternatives available domestically. According to another Reuters report, ByteDance expects to spend around 100 billion yuan ($14.3 billion) on Nvidia’s artificial intelligence chips in 2026, a sharp rise from an estimated ¥85 billion spent in 2025.

The situation also carries regulatory risk, since Beijing has not yet formally approved imports of the H200. Chinese chip companies seeking government approval to build new factories or expand existing ones are being required by local officials to show that at least half of their equipment comes from domestic suppliers.

What Are Stocktwits Users Saying?

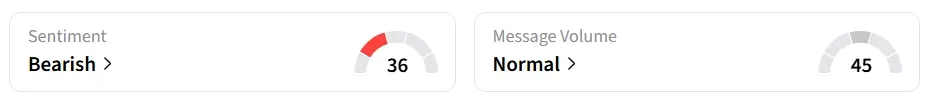

On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘normal’ message volume levels.

A bullish Stocktwits user expected the ‘average price target to jump close to $300.’

NVDA stock has gained over 39% year-to-date.

Also See: Elon Musk Is Ramping AI Compute At Breakneck Speed — Inside xAI’s Expanding Data Center Footprint

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246877055_jpg_1283ae3088.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)