Advertisement|Remove ads.

Wayfair Stock Surges After Report Of Tech Layoffs: Retail Sentiment Subdued

Shares of Wayfair Inc. (W) surged more than 6% on Friday as the furniture retailer reportedly cut 340 technology-related jobs as part of its reorganization, but retail sentiment remained subdued.

The Wall Street Journal reported the move to cut jobs is also aimed at the company’s plan to use generative AI following its shift to a cloud-based computing environment.

Wayfair will see charges between $33 million to $38 million as a result of these cuts.

The company is reportedly also shutting its technology development center in Austin, Texas that will also provide some additional savings.

“With the foundation of this transformation now in place, our technology needs have shifted,” Wayfair reportedly said in a blog post. “To best support Wayfair’s next phase of growth, we must refocus our resources, streamline our operations and ensure our teams are structured for long-term success.”

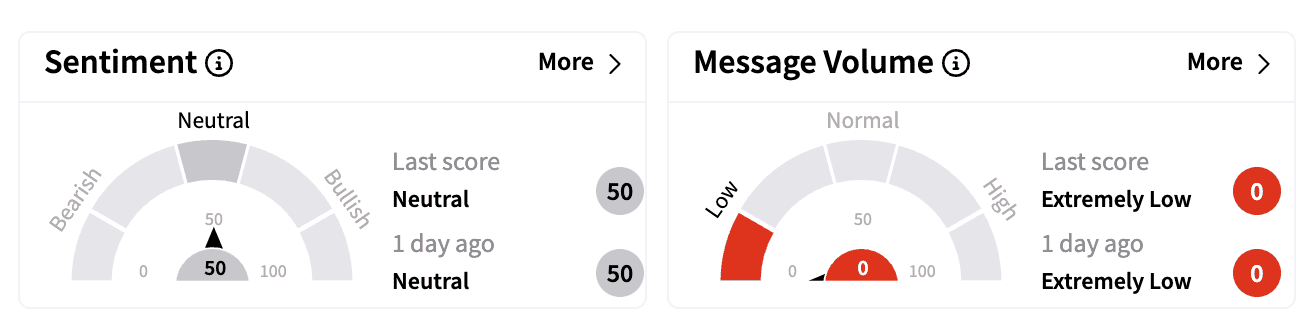

Sentiment on Stocktwits ended Friday in the ‘neutral’ zone. Message volume was in the ‘extremely low’ territory.

One bullish watcher predicted that the march towards $40 had begun.

Boston-based Wayfair reported earnings per share of $0.22 in its most recent quarter, beating estimates by 64.8%, according to Stocktwits data.

“The home goods industry is inherently cyclical, but the past few years have been particularly volatile,” the company stated in a shareholder letter in February. “A confluence of macroeconomic factors - shifts in discretionary spending post-pandemic, supply chain disruptions, and historically high mortgage rates - have significantly impacted the housing market and, in turn, our category.”

Wayfair stock is down 21% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_OG_jpg_187c6126ee.webp)