Advertisement|Remove ads.

We Asked Retail What’s Their View On Webull Stock: After 400% Rally, Majority Still Say They Are Bullish

Shares of online trading platform Webull soared over 400% on Monday after the company went public on Friday following a merger with a special purpose acquisition vehicle (SPAC) SK Growth Opportunities Corporation.

Webull Corporation, headquartered in St. Petersburg, Florida, operates in 15 regions globally and is backed by private equity investors located in the United States, Europe and Asia. The company serves 20 million registered users globally.

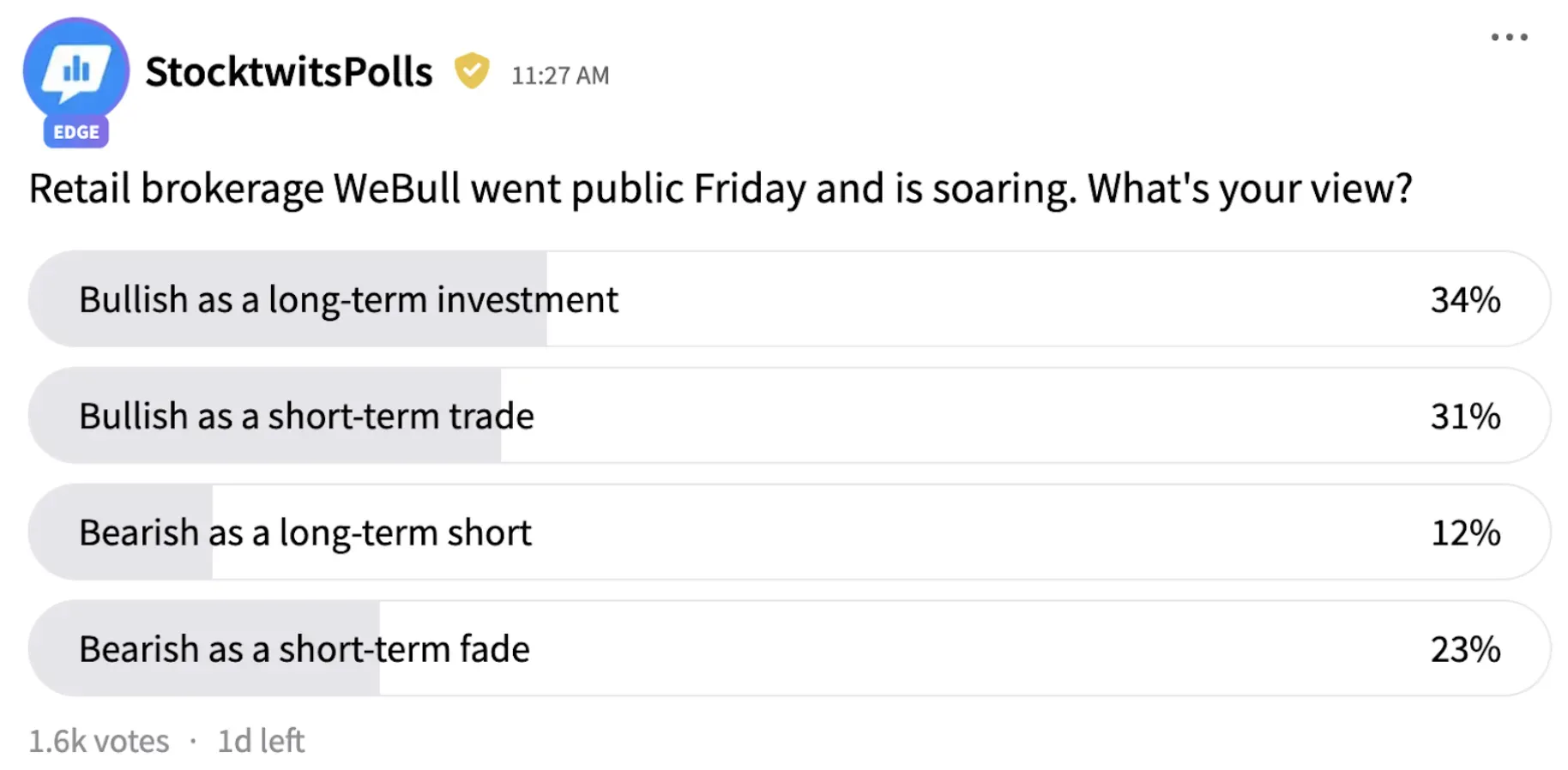

According to an ongoing poll on Stocktwits, a majority of the Stocktwits users who responded to the poll indicated they were bullish on the stock.

Thirty-four percent of the respondents said they were bullish on the stock as a long-term investment, while 31% held a positive view as a short-term trade.

Twenty-three percent respondents were bearish on the stock in the short-term while 12% have a pessimistic take from a long-term perspective.

Last month, Webull announced the launch of its elite membership offering called Webull Premium. The subscription unifies a set of products, including margin rates, deposit promotions, and discounted trading fees under a single upgraded experience.

The company had priced the subscription to U.S. customers for $3.99/month or $40/year.

In February, the company partnered with Kalshi, the first CFTC-regulated exchange with prediction markets, to offer users the ability to trade binary event contracts through the Webull platform.

The company said that the partnership will provide Webull users with a unique, CFTC-regulated product, allowing them to be more precise with risk management around intraday market movements by utilizing a cash-settled short-term contract.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)