Advertisement|Remove ads.

Wells Fargo Sees More Upside For AMD As Datacenter Growth Accelerates: Retail Maintains Optimism

Advanced Micro Devices Inc.(AMD) may have more room to run, said Wells Fargo, which boosted its outlook for the chipmaker ahead of its quarterly earnings release.

According to a CNBC report, the firm’s analyst Aaron Rakers lifted the stock’s price target to $185 from $120, implying an 18.9% upside from the prior session’s close, as per TheFly.

Following the price target increase, AMD stock inched 0.1% higher in Wednesday’s premarket session.

The analyst reiterated an ‘Overweight’ rating on the shares, suggesting confidence in AMD’s momentum across datacenter and enterprise segments.

Rakers pointed to AMD’s growing presence in the datacenter graphics processing unit (GPU) space, particularly with the ramp-up of the MI355X chips, which began shipping recently.

AMD has experienced a sharp rally, climbing over 76% in the last three months, significantly outpacing the S&P 500's performance during the same period.

Its six-month gain also stands strong at more than 31%, reinforcing investor confidence heading into the company’s earnings report on August 5.

Rakers anticipates that the forthcoming earnings will underscore AMD’s increasing presence in the datacenter sector and its consistent delivery on product plans.

He highlighted the significance of the next-gen Epyc chips, known as Turin, and noted steady traction with the Zen 4-powered Genoa and Bergamo processors. These advancements suggest AMD is steadily capturing a larger portion of the server central processing unit (CPU) space.

The analyst believes there’s further upside, especially with enterprise-driven growth gaining traction.

AMD’s first-quarter (Q1) revenue jumped 36% year-on-year (YoY) to $7.44 billion, exceeding forecasts of $7.12 billion, as per Fiscal AI data. Q1 data center revenue rose 57% YoY to $3.7 billion.

The company anticipates Q2 revenue of $7.4 billion, plus or minus $300 million.

AMD announced on Tuesday that it is preparing to resume deliveries of its MI308 AI chips to China after receiving temporary approval from U.S. authorities, a move that could result in $800 million in additional revenue.

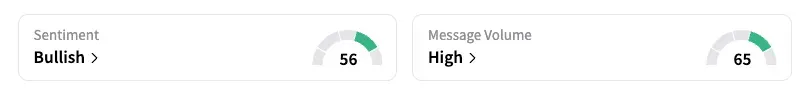

On Stocktwits, retail sentiment around AMD remained in ‘bullish’ territory amid ‘high’ message volume levels.

AMD stock has gained over 28% year-to-date and lost over 12% in the past 12 months.

Also See: Roblox Retail Traders Stay Bullish As JPMorgan Lifts Price Target On Surging Engagement Trends

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)