Advertisement|Remove ads.

Wells Fargo Stock Upgraded By RBC Capital, Analyst Expects Bank To See Regulatory Benefit — Retail Sentiment Improves

Wells Fargo & Co (WFC) shares traded in the green on Thursday after RBC Capital analyst Gerard Cassidy upgraded the stock to ‘Outperform’ from ‘Sector Perform’ and maintained the price target of $80.

According to a CNBC report, the analyst believes the recent stock price correction has created an opportunity to buy the stock.

“WFC, under the leadership of CEO Charlie Scharf, has executed on its plan to satisfy all its regulatory issues while increasing profitability,” Cassidy stated.

The RBC analyst also indicated that Wells Fargo could hit a higher valuation once it lifts its asset cap and achieves a 15% return on average common equity.

Cassidy added that Wells Fargo is well capitalized and may see regulatory relief based on expectations for a less onerous regulatory environment. “The company remains committed to returning excess capital via dividend payments and opportunistic share repurchases,” he said.

Earlier this week, Bank of America analyst Ebrahim Poonawala lowered his stock price target to $85 from $90 and kept a ‘Buy’ rating on the shares.

In its fourth-quarter earnings report, Wells Fargo announced healthy guidance for 2025. For the current year, the bank expects net interest income to be approximately 1% to 3% higher than the 2024 figure of $47.7 billion.

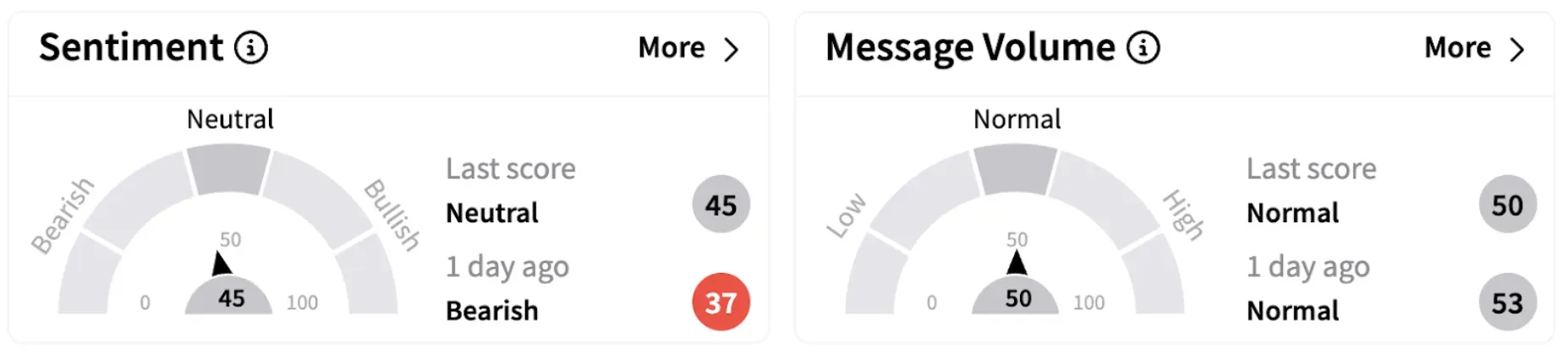

Meanwhile, on Stocktwits, retail sentiment climbed into the ‘neutral’ territory (45/100) from ‘bearish’ a day ago.

Wells Fargo shares have lost over 1% in 2025 but are up over 19% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)