Advertisement|Remove ads.

SoFi Technologies Stock Draws Retail Attention After $5B Loan Platform Business Agreement With Blue Owl Capital Funds

Shares of fintech company SoFi Technologies Inc (SOFI) were in the spotlight on Thursday after the firm announced the signing of its largest loan platform business agreement worth $5 billion.

SoFi said it has finalized a two-year agreement with funds managed by Blue Owl Capital, an asset manager with over $250 billion in assets under management.

The company’s loan platform business refers pre-qualified borrowers to loan origination partners and originates loans on behalf of third parties.

The deal comes amid a growing demand for personal loans from its members and debt investors. The company believes this will advance its strategy to diversify revenue streams with less capital-intensive and more fee-based sources of revenue.

Last year, SoFi’s loan platform business originated $2.1 billion of loans. Through the business, the company earns a fee income to originate loans on behalf of partners while retaining servicing rights.

CEO Anthony Noto said the deal is two times its first commitment, diversifying toward less capital-intensive and more fee-based revenue sources.

Ivan Zinn, Head of Alternative Credit at Blue Owl, noted that they see a strong opportunity in participating in this growth through this strategic program.

SoFi recently announced the issuance of $697.6 million in notes secured by a pool of personal loans originated by SoFi Bank, N.A.

The firm noted that this marked the first securitization of new collateral in SoFi’s Consumer Loan Program since 2021 and the first using collateral that originated in the loan platform business.

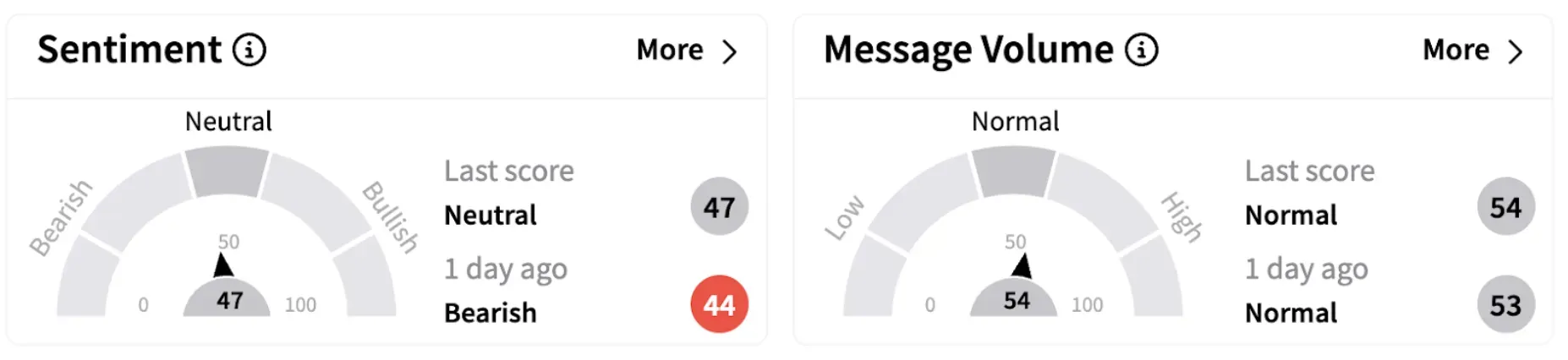

Meanwhile, on Stocktwits, retail sentiment climbed into the ‘neutral’ territory (47/100) from ‘bearish’ a day ago.

One Stocktwits user expressed optimism on the deal.

SoFi shares have lost over 15% in 2025 but have gained over 61% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)