Advertisement|Remove ads.

What’s Driving RVYL Stock’s Rally This Week?

- Interest has accelerated following updated S-4 registration statements tied to the proposed combination.

- The company recently secured formal confirmation from the Nasdaq Stock Market that its shares met the exchange’s minimum bid price requirement.

- Ryvyl expects to close its merger with Roundtable in the third quarter of 2026.

Ryvyl Inc. (RVYL) has captured investor attention as it moves closer to completing a merger with Roundtable, a transaction that supporters believe could reshape the company’s future. Recent regulatory filings and operational milestones have fueled renewed interest in the thinly traded stock.

Merger Driving Retail Interest

Retail interest has accelerated following updated S-4 registration statements tied to the proposed combination. The filings outline steps toward meeting Nasdaq listing standards while detailing how the merged entity plans to operate as a digital media and Web3-focused business.

The company said on Tuesday that it recently received formal confirmation from The Nasdaq Stock Market that its shares met the exchange’s minimum bid price requirement, which mandates a closing stock price above $1.00 for at least 10 consecutive business days.

Clearing Nasdaq requirements preserves RVYL’s listing and paves the way for its integration with Roundtable’s decentralized media platform. Ryvyl stock traded 87% higher in Friday’s premarket.

What Are Stocktwits Users Saying?

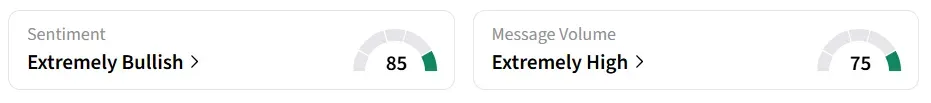

On Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ from ‘bearish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘low’ levels in 24 hours.

Ryvyl’s limited public float has led some traders to discuss the possibility of a short squeeze.

Stocktwits users pointed to the low-floater play.

Ryvyl expects to close its merger with Roundtable in the third quarter of 2026, pending customary regulatory and closing conditions. If completed, the deal could change Ryvyl’s focus toward blending payment infrastructure with blockchain-enabled media services.

Roundtable operates as a Web3-based digital media software company that offers tools for media organizations and journalists.

RVYL stock has declined by over 87% in the last 12 months.

Also See: Tesla Stock Rises Premarket: Musk Signals FSD Price Hike As Autonomy Push Accelerates

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)