Advertisement|Remove ads.

What Is A Secondary Offering?

- Secondary public offerings can either be dilutive or non-dilutive.

- Depending on the structure, proceeds may go to the company, existing shareholders, or both, as outlined in SEC filings.

- Secondary offerings can cause short-term stock volatility, making it important for investors to understand who is selling and why.

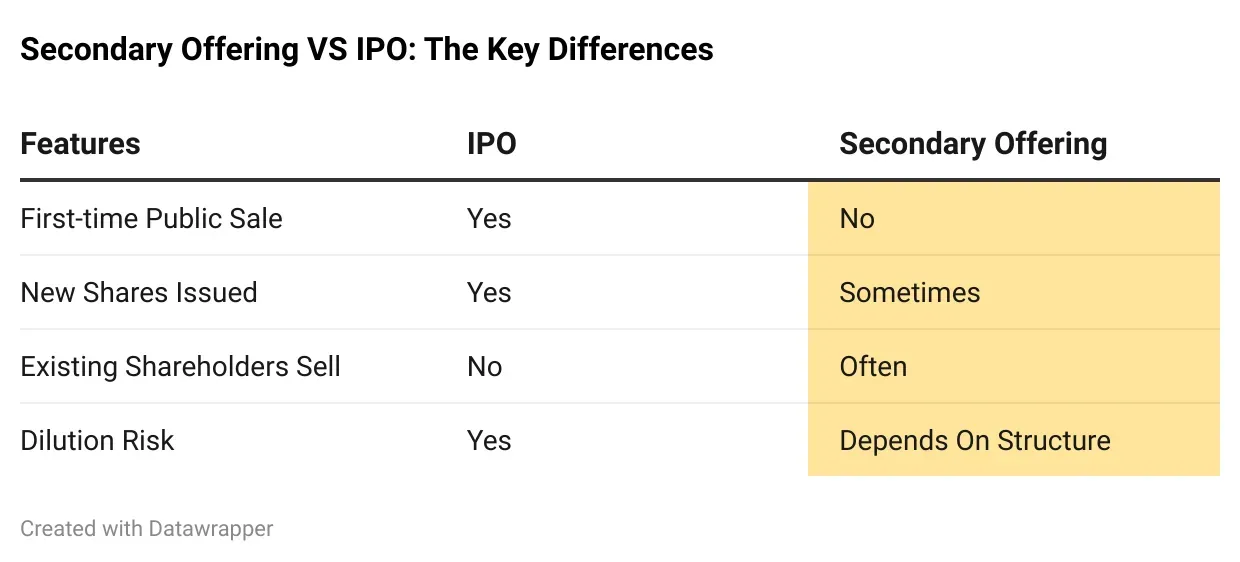

A secondary offering is the sale of shares after a company has already gone public, typically following its initial public offering (IPO). In simple terms, the company is not entering the stock market for the first time; it already did so during its initial public offering (IPO).

Secondary offerings can involve:

- Existing shareholders selling their shares.

- Newly issued shares sold by the company.

- A combination of both.

As a result, a secondary offering can change who owns the shares, how many shares are outstanding, or how many are available to trade in the public market.

Primary vs. Secondary Securities

Not all share sales are the same. In the public markets, there is a clear difference between primary and secondary securities.

- Primary securities are additional shares issued by the company itself, with the money raised going directly to the business.

- Secondary securities, on the other hand, are existing shares sold by current shareholders.

This distinction becomes especially important in secondary offerings, which may include one or both types of securities. SEC prospectuses and prospectus supplements clearly spell this out, showing whether the company or the selling shareholders will receive the proceeds.

Types of Secondary Offerings

Secondary public offerings can either be dilutive or non-dilutive.

In a dilutive secondary offering, the company issues new shares, increasing the total number of shares outstanding. Although these offerings occur after the IPO, the newly issued portion functions as a primary issuance and can dilute existing shareholders’ ownership and earnings per share.

In a non-dilutive secondary offering, current shareholders sell their existing shares, while the overall share count remains unchanged. In this case, the company does not receive proceeds, but the public float increases.

This distinction, which is clearly disclosed in SEC documents, matters because it affects ownership, earnings per share, and stock valuation.

Why Do Companies Offer Secondary Offerings?

Companies turn to secondary offerings for practical reasons. When new shares are issued, the capital raised can be used to fund growth, pay down debt, or support acquisitions, as outlined in SEC filings.

Even in non-dilutive secondary offerings, companies may benefit indirectly through improved liquidity, broader ownership, and more efficient price discovery.

Why Do Shareholders Sell In Secondary Offerings?

For shareholders, these offerings provide a way to gain liquidity, rebalance portfolios, or exit investments made years earlier. Encyclopaedia Britannica notes that this process is a regular part of well-functioning, mature financial markets.

What Secondary Offerings Mean for Investors

Secondary offerings often mean short-term uncertainty for investors. When the number of available shares increases, it can put downward pressure on a stock. Large insider sales may raise questions about management's confidence in the company's future.

That's why the CFA Institute emphasizes the importance of reading the fine print in SEC filings. Knowing who is selling, whether new shares are being issued, and how the proceeds will be used gives investors insight into whether a secondary offering supports the company’s long-term goals.

Over the longer term, however, increased liquidity and a broader investor base can help stabilize trading and reduce volatility.

Also See: FedEx Stock Jumps After Hours As Solid Q2 Lifts Full Year Outlook; $1B Cost-Cut Plan For Year Intact

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240244443_jpg_6b67e8f303.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)