Advertisement|Remove ads.

When Does Nvidia Report Q3 Earnings?

- Analysts expect Nvidia to report a third-quarter revenue of $55.03 billion.

- Nvidia’s dominant architecture and strong relationships with cloud providers give a competitive edge.

- Nvidia’s stock traded over 3% higher on Wednesday morning.

NVIDIA Inc. (NVDA) is attracting significant market attention as the AI bellwether is expected to report its third-quarter fiscal 2026 results on Wednesday after the closing bell.

The chip giant will report earnings in a volatile environment, as big tech companies’ capital expenditure spirals to ramp up AI infrastructure, prompting investors to be cautious about valuations.

Third-Quarter Expectation

For the third quarter (Q3), Nvidia is projected to post adjusted earnings per share (EPS) of $1.25 and revenue of $55.03 billion, according to Fiscal AI data.

The revenue expectation is slightly above the $54 billion (+/- 2%) guidance Nvidia provided in late August following its second-quarter report.

According to a CNBC report, an Internal survey by traders at JPMorgan indicates potential revenue of $56.32 billion for Q3 and $63.02 billion for Q4, which would exceed analyst expectations by more than $1.3 billion per quarter.

“It feels increasingly like the weight of the world is on NVDA,” JPMorgan noted, referring to the stock’s recent volatility.

Optimism Amid Tech Pullback

Earlier on Wednesday, Daniel Ives, managing director at Wedbush Securities, said Nvidia is the sole company forming the foundation for the AI revolution.

Nvidia’s dominant architecture, large developer ecosystem and strong relationships with cloud providers give a competitive edge that few rivals can match, especially in the enterprise AI space.

How Did Stocktwits Users React?

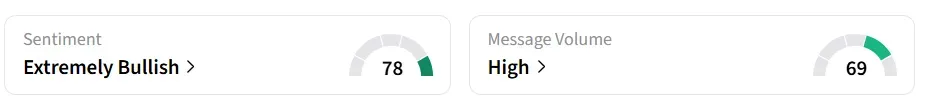

Nvidia’s stock traded over 3% higher on Wednesday, after the morning bell. On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘high’ message volume levels.

A Stocktwits user said Nvidia CEO Jensen Huang’s forecast will have more impact on entire market than Trumps tariffs.

Another user said Huang’s projections will be optimistic.

Also See: Blue Owl Scraps Merger Of Funds Amid Market Uncertainty

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)