Advertisement|Remove ads.

WhiteFiber Stock Pops 25% Premarket On $865M Nscale Data Center Deal – Retail Traders Price In Long-Term AI Revenue

- WhiteFiber will deliver 40 megawatts of critical IT load at the NC-1 data center campus in Madison, North Carolina, in two 20-megawatt phases.

- WhiteFiber said it has invested roughly $150 million in equity into the NC-1 site and is in advanced talks with multiple lenders.

- The company said it expects to deliver new campuses in 2026 and 2027.

WhiteFiber (WYFI) shares rose 25% in premarket trading on Friday after the company announced a data center colocation agreement with Nscale Global that is expected to generate around $865 million in contracted revenue.

WYFI was among the top trending tickers on Stocktwits at the time of writing.

Details Of The Deal

WhiteFiber’s subsidiary, Enovum Data Centers Corp., signed a long-term colocation agreement with Nscale Global, under which WhiteFiber will deliver 40 megawatts of critical IT load at the NC-1 data center campus in Madison, North Carolina, in two 20-megawatt phases.

The contract represents approximately $865 million in contracted revenue over an initial 10-year term. Nscale plans to use the capacity to support AI infrastructure for global technology customers.

WhiteFiber said it has invested roughly $150 million in equity into the NC-1 site and expects to finalize a construction credit facility in early 2026 to support both near-term development and long-term expansion. It is also in advanced talks with multiple lenders.

The company added that momentum from the agreement is already driving additional projects across its U.S. colocation pipeline, with new campuses targeted for delivery in 2026 and 2027.

“This agreement validates our strategy to engineer NC-1 to meet hyperscaler specifications and support the most advanced AI workloads. We look forward to working closely with Nscale as we plan for the potential expansion of this deployment toward double its initial size by the end of 2027,” said Sam Tabar, CEO of WhiteFiber.

How Did Stocktwits Users React?

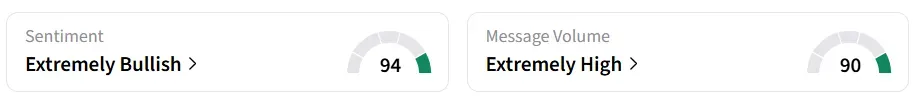

On Stocktwits, retail sentiment turned ‘extremely bullish’ from ‘bullish’ amid ‘extremely high’ message volumes.

One user sees support in the $16.6-$17.2 zone, and a break beyond that could take it to $20. It is currently at $17.6.

Another user noted improved revenue visibility. It had posted a 65% increase in third-quarter revenue.

Earlier this week, Compass Point initiated coverage of WhiteFiber, which went public in August, with a “Buy” rating and a $32 price target, according to The Fly.

Read also: MSTR, BMNR Rise After BOJ Rate Decision Results In Bitcoin, Ethereum Rebound

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)