Advertisement|Remove ads.

AMAT Stock Is Breaking Out – Here’s What Changed

- RBC remains constructive on wafer fab investment and expects Applied Materials to deliver growth at least in line with the sector over the next 12 months.

- Barclays said that the recent recovery in DRAM spending makes the shares attractive.

- AMAT shares are on track to open at their highest ever levels.

Applied Materials (AMAT) tracked the interest in the semiconductor sector on Thursday, with the stock jumping 8% in pre-market trading. It is on track to open at its highest-ever levels following a slew of favourable brokerage action and Taiwan Semiconductor Manufacturing Co’s (TSMC) increased expenditure forecast, following a smashing fourth-quarter (Q4) earnings report.

What Are The Brokerages Saying?

RBC Capital initiated coverage of Applied Materials with an ‘Outperform’ rating and a price target of $385, an 18% upside to the current premarket price of $325.4, according to The Fly. The stock beat the SOX index (PHLX Semiconductor Sector) last year but trailed U.S. equipment peers, weighed down by China-related headwinds, softer spending on mature nodes, and potential share losses. Despite this, the RBC remains constructive on wafer fab investment and expects Applied Materials to deliver growth at least in line with the sector over the next 12 months.

Barclays upgraded the stock to ‘Overweight’ from ‘Equal Weight’ and raised the price target to $360 from $250. Analyst Tom O'Malley said that the recent recovery in DRAM spending makes the shares attractive, with AMAT’s exposure to the memory market turning more favorable in 2026.

Wells Fargo raised Applied Materials' price target to $350 from $290, and maintained an ‘Overweight’ rating.

TSMC Raises 2026 CAPEX Plans

Applied Materials, a chip equipment maker and a key supplier for TSMC, is also likely to benefit from the largest semiconductor manufacturer in the world increasing its capital expenditure for 2026 by 37% to $56 billion.

Applied Materials also found favour with firms including Stifel, Bank of America (BoFA), and Bernstein, who expect the company to benefit from the increased expenditure in the semiconductor wafer fab equipment market.

How Did Retail React?

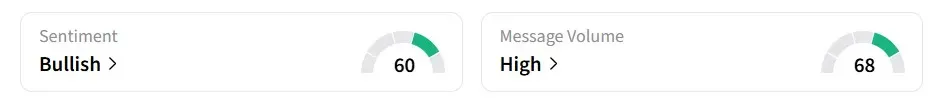

Retail sentiment for AMAT on Stocktwits remained in the ‘bullish’ territory over the past 24 hours, amid ‘high’ message volumes.

The stock has gained around 76% over the past year.

Read also: BlackRock Stock Rises Pre-Market: Record Inflows Drive Q4 Revenue Beat

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)