Advertisement|Remove ads.

Why Chip-equipment Maker Applied Materials’ Stock Fell After-hours

Chip-equipment maker Applied Materials, Inc.’s (AMAT) stock fell 2.75% in Thursday’s extended trading after the company warned of a revenue hit from the U.S. government’s new China semiconductor curb rule.

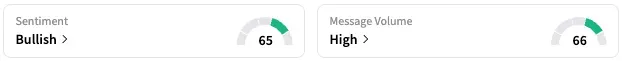

Notwithstanding the negative headline, the sentiment of retail users of the Stocktwits platform toward Applied Materials stock remained ‘bullish’ as of late Thursday, and the message volume improved to ‘high’ levels.

In a filing with the SEC, the company stated late Thursday that the Commerce Department’s new rule, issued on September 29, expanded the list of companies subject to U.S. export curbs, further restricting its ability to export certain products and provide specific parts and services to certain China-based customers without a license.

The new rule is expected to result in a $110 million reduction in the company’s fourth-quarter revenue and a $600 million decrease in revenue for the next fiscal year (2026).

Applied Materials' stock took a tumble in mid-August after the company's soft third-quarter guidance, issued along with its second-quarter earnings report, dented investor sentiment. Blaming an anticipated slowdown in China and reduced demand for advanced logic and memory chips, the company guided fourth-quarter revenue between $6.2 billion and $7.2 billion, and an adjusted earnings per share (EPS) in the range of $1.91 and $2.31, which trailed the then-consensus estimates.

According to Fiscal.ai, the consensus revenue and EPS estimates currently stand at $6.71 billion and $2.12, respectively.

A bullish user on Stocktwits said they would be averaging up on Friday, adding that “Every dip needs to be swallowed here, chips can’t be made without this guy.”

Another user expected the stock to cut its losses and turn green by Friday morning, attributing their optimism to the strength of the Trump market.

https://stocktwits.com/Alvi722/message/630870144

Applied Materials' stock has gained about 39% this year, recovering the post-earnings dip seen in August.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Why Rumble Stock Spiked Over 11% In After-hours Today.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)