Advertisement|Remove ads.

Why CADL Stock Plunged Nearly 15% In After-Hours Trading Today

- The $100 million equity raise is expected to fund commercialization preparations for CAN-2409 in early-stage, localized prostate cancer.

- Candel also plans to use part of the funds to support the ongoing phase 3 trial of CAN-2409 in non-small cell lung cancer.

- RTW is set to receive a tiered single-digit percentage of U.S. net sales, subject to a cap.

Shares of Candel Therapeutics, Inc. (CADL) fell 14% in extended trading on Thursday, after the company outlined plans for a $100 million public stock offering, outweighing a $100 million royalty funding agreement announced the same day.

Candel Launches $100M Public Offering

Candel said it has launched an underwritten public offering of $100 million of its common stock. The underwriters have also been granted a 30-day option to purchase up to an additional $15 million in shares on the same terms.

According to the company, the proceeds will go toward preparing for the potential launch of Aglatimagene Besadenovec, also known as CAN-2409, in early-stage, localized prostate cancer. This includes medical affairs, launch readiness and other commercialization-related work. Candel also plans to use part of the funds to support the ongoing phase 3 trial of CAN-2409 in non-small cell lung cancer.

RTW Royalty Deal Adds $100M In Funding

Earlier in the day, Candel separately disclosed a $100 million royalty funding agreement with funds managed by RTW Investments. The deal will support a potential U.S. launch of CAN-2409 in intermediate to high-risk localized prostate cancer.

The royalty financing is tied to regulatory progress. It will become available upon approval of CAN-2409 by the U.S. Food and Drug Administration (FDA). Under the terms of the agreement, RTW would receive a tiered single-digit percentage of annual U.S. net sales of the therapy, subject to a cap.

How Did Stocktwits Users React?

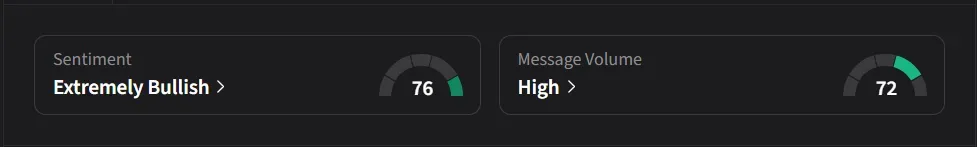

On Stocktwits, retail sentiment for CADL was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “At the end of the day, this stock has lots of potential due to its pipeline. Trade away as needed. Just don’t be surprised when it flies.”

Another user said they want to see RTW participate in the deal alongside other “prominent” biotech investors, including Manning and “high-quality” institutional funds such as T. Rowe Price. “If we see this, the stock will perform well finally. I do not want to see CVI, Susquehanna, or any of these low-quality players,” they added.

CADL stock has risen 5% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)