Advertisement|Remove ads.

CLSK Stock Receives Premarket Boost On Texas Data Center Deal

- The deal marks CleanSpark’s second Houston-area project, creating a regional power hub with over 890 MW of potential capacity.

- The transaction is expected to close by the first quarter of fiscal 2026.

- The deal adds to the company’s portfolio of more than 1.4 GW of power across the United States.

Shares of CleanSpark, Inc. (CLSK) gained 6% in premarket trading on Wednesday, after the company announced an agreement that positions it to develop a large-scale data center project in Texas.

CleanSpark signed an agreement to acquire up to 447 acres in Brazoria County along with a long-term transmission extension, allowing for the establishment of a 300 MW data center with potential expansion to 600 MW. The deal is expected to close by the first quarter (Q1) of fiscal 2026.

This marks CleanSpark’s second major development in the greater Houston region, joining its Austin County site to create a regional power hub with over 890 MW of potential capacity.

"Clustered capacity is a critical differentiator for customers planning large, multi-campus deployments. With this addition, we are approaching a gigawatt of total potential capacity in the Houston area. That scale, combined with our flexibility to deploy both in front of and behind the meter, positions us to deliver a true AI factory offering in one of the most important power markets in the country,” said Jeff Thomas, Senior Vice President of AI Data Centers at CleanSpark.

The latest deal adds to the company’s portfolio of more than 1.4 GW of power, land, and data centers across the United States. CleanSpark, primarily a Bitcoin miner, has had a stellar fiscal year 2025, with revenues more than doubling to $766.3 million, helping turn a loss of $145.8 million into a profit of $364.5 million.

How Did Stocktwits Users React?

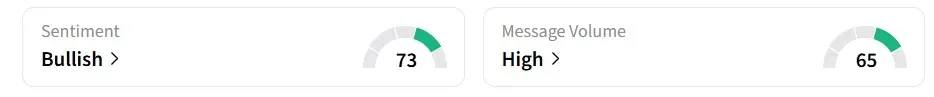

Retail sentiment on Stocktwits flipped to ‘bullish’ from ‘neutral’ a day earlier, accompanied by ‘high’ message volumes. CLSK was among the top trending tickers on Stocktwits at the time of writing.

Multiple users saw $60 as a key price target for the stock, which is significantly more than the current price of $13.3.

Another bullish user said the company “locked up one of the scarcest assets in AI.”

The stock has gained 32% over the past year.

Read also: WKEY Stock Catches Retail Attention After Unit Enters Talks To Acquire French Quantum Tech Firm

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)