Advertisement|Remove ads.

Why Did ASTS Stock Tumble 6% Pre-Market Today?

- Scotiabank reassessed the company's market position amid concerns over valuation and revenue timelines.

- The firm downgraded AST SpaceMobile (ASTS) stock to ‘Underperform’ from ‘Sector Perform.’

- The firm highlighted a history of timing missteps in market execution and slow adoption among U.S. and Japanese customers.

Scotiabank has downgraded AST SpaceMobile (ASTS) stock to ‘Underperform’ from ‘Sector Perform’ and has a price target of $45.60 per share.

The move comes as the firm reassesses the company's market position amid concerns over valuation and revenue timelines.

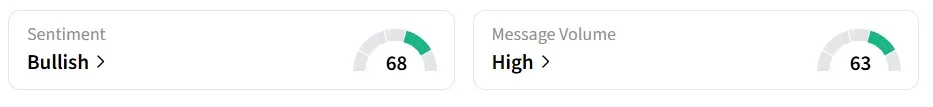

Following the downgrade, AST SpaceMobile stock traded over 6% lower in Wednesday’s premarket. However, on Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

Caution On Overvaluation

Scotiabank said, AST SpaceMobile’s stock has "once again overshoot to what we see as irrational levels," indicating that the shares may be trading well above reasonable expectations, according to TheFly.

The firm’s middle-ground assessment estimates a fair value range between $45 and $55 per share. While the firm acknowledged that AST SpaceMobile’s technology is "impressive," it also highlighted a history of timing missteps in market execution.

Slow adoption among U.S. and Japanese customers, modest average revenue per user (ARPU), and substantial capital expenditures are cited as reasons why meaningful cash flow may not materialize until 2028 or 2029.

Strong Performance

AST SpaceMobile has attracted significant investor interest following a strong rally last year. Its plan to offer global cellular broadband through its BlueBird satellites has generated excitement.

As of Tuesday’s close, AST SpaceMobile shares have risen 32% so far this year and over 323% in the last 12 months.

ASTS expects to send satellites into orbit roughly every 45 days throughout 2026, a pace intended to support the continuous expansion of its low Earth orbit network. Its BlueBird satellites are built to provide fast, always-on mobile internet directly to regular smartphones worldwide.

Also See: D-Wave Acquires Quantum Circuits For $550M To Boost ‘Fault-Tolerant Quantum Computing’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)