Advertisement|Remove ads.

Why Did CETX Stock Surge 30% In Pre-market Today?

- The deal broadens Cemtrex’s capabilities in high-reliability electronics, flight instrumentation, and advanced system design.

- Cemtrex acquired 100% of Invocon’s outstanding shares for $7.06 million, according to an earlier press release.

- Invocon’s technologies have been used for 17 space shuttle systems and 10 international space station systems, among others.

Shares of Cemtrex Inc. (CETX) jumped nearly 30% in premarket trading on Friday after the company formally launched its Aerospace & Defense segment following the acquisition of Invocon, a Texas-based aerospace and defense engineering firm.

According to a press release in November last year, Cemtrex acquired 100% of Invocon’s outstanding shares for $7.06 million.

Cemtrex said near-term priorities include maintaining customer continuity, expanding proposal activity across missile defense and aerospace programs, and evaluating additional strategic opportunities.

Acquisition Rationale

The acquisition expands Cemtrex’s capabilities in high-reliability electronics, flight instrumentation, wireless data acquisition, and complex system design.

Invocon brings nearly four decades of experience developing advanced instrumentation, wireless sensing, and telemetry systems for satellites, launch vehicles, missiles, and space-based platforms. Its technologies have supported major government programs, including 17 space shuttle systems and 10 international space station systems, and have flown on more than 40 shuttle missions and over 30 target missile flights.

The company also maintains long-standing relationships with the Missile Defense Agency and has a strong intellectual property portfolio covering hypervelocity impact detection, advanced sensing, and flight-system telemetry.

Last month, Invocon secured awards under the Missile Defense Agency’s SHIELD IDIQ contract, a multi-award program with a total ceiling of up to $151 billion.

“With the acquisition closed, we are focused on expanding Invocon’s participation across missile defense modernization, prime contractor programs, and space systems where reliability and execution determine outcomes. SHIELD strengthens our access to programs designed specifically to move faster, deploy new capabilities more rapidly, and deliver layered defense solutions at scale,” said Saagar Govil, Cemtrex Chairman and CEO.

How Did Stocktwits Users React?

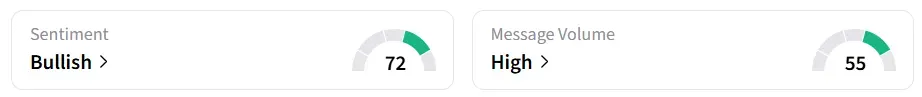

Retail sentiment for CETX on Stocktwits flipped to ‘bullish’ from ‘bearish’ over the past 24 hours, amid ‘high’ message volumes.

One bullish user expects the stock price to climb up to $8-10 following the acquisition. It is currently trading at $3.7.

Another user highlighted a potential technical indicator.

Read also: Balaji Srinivasan Backs Zcash Developers After Team Exits And Launches New Wallet - ZEC Price Gains

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)