Advertisement|Remove ads.

This Software Company Saw Significant High-Value Client Additions And An Upbeat Q4 – Stock Shot Up 17% Pre-Market Today

- Datadog’s Q4 revenue rose 29% YoY to $953 million, fueled by expansion among large enterprise clients and adoption of its cloud monitoring solutions.

- Both Q4 revenue and EPS surpassed the analysts’ consensus estimate of $916.7 million and $0.55, respectively, according to Fiscal AI data.

- The company had roughly 4,310 customers with ARR of $100,000 or more, a 19% Year-on-year increase.

Datadog, Inc. (DDOG) on Tuesday reported a 31% year-on-year growth in large customers with $1 million in annual recurring revenue (ARR) in 2025.

The company released its fourth-quarter (Q4) earnings and highlighted new AI-powered tools designed to help organizations optimize cloud operations and security.

Q4 Financial Performance

Datadog’s Q4 revenue rose 29% YoY to $953 million, fueled by expansion among large enterprise clients and broader adoption of its cloud monitoring solutions. Its adjusted earnings per share (EPS) was $0.59. Both revenue and EPS surpassed the analysts’ consensus estimate of $916.7 million and $0.55, respectively, according to Fiscal AI data.

"During 2025, we delivered over 400 new features and capabilities to help our customers as they migrate to the cloud and begin to deploy to production with next-gen AI."

-Olivier Pomel, Co-founder and CEO, Datadog

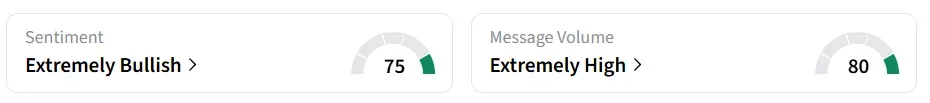

Datadog stock traded over 17% higher in Tuesday’s premarket. On Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ from ‘bearish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

Customer Growth And Outlook

Datadog added considerable high-value clients, ending the year with 603 customers generating $1 million or more in ARR, up from 462 the previous year. Additionally, the company had roughly 4,310 customers with ARR of $100,000 or more, a 19% YoY increase.

In Q4, adjusted operating income grew 28% You to $230 million with a profit margin of 24%.

Datadog projects Q1 revenue between $951 million and $961 million, with adjusted EPS in the range of $0.49 to $0.51. For the full year 2026, revenue is expected between $4.06 billion and $4.10 billion, with adjusted EPS in the range of $2.08 to $2.16.

DDOG stock has declined by over 22% in the last 12 months.

Also See: MAS Stock Jumped Over 4% Today – Here’s Everything To Know About The Massive Share Buyback

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)