Advertisement|Remove ads.

Why Did Eos Energy Stock Fall Over 3% After-Hours?

- It also registered a direct offering of common stock to a limited number of purchasers with Goldman Sachs as the sole placement agent.

- The energy storage solutions firm said it would use the proceeds for debt repayments and for general corporate purposes.

- The company also said the Department of Energy, which granted a $303 million loan last year for its manufacturing facilities, approved the offerings.

Eos Energy Enterprises (EOSE) stock fell 3.6% in extended trading on Tuesday after the company said it intends to offer convertible bonds and sell shares to raise capital.

The company said it would put on sale notes worth $500 million due in 2031. Eos Energy also expects to grant the initial purchasers of the six-year bonds an option to purchase up to an additional $75 million in principal amount of notes, subject to certain conditions. It also registered a direct offering of common stock to a limited number of purchasers with Goldman Sachs as the sole placement agent.

Why Does Eos Energy Want To Raise The Money?

The energy storage solutions firm said it would use the proceeds from the twin offerings to repurchase a portion of its outstanding 6.75% convertible senior notes due 2030 and for general corporate purposes. The company had over 288 million outstanding shares and a market capitalization of $3.8 billion as of Tuesday’s close. The stock had hit a four-year high earlier this month.

Eos Energy is rapidly expanding its U.S. manufacturing capabilities to tap into booming demand from AI data centers. The U.S. Energy Information Administration projects that U.S. power demand will set new records in both 2025 and 2026, further straining the grid. Large-scale developers are now seeking off-grid power solutions to ensure reliable power for data centers.

What Are Stocktwits Users Thinking?

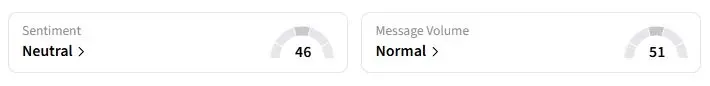

Retail sentiment on Stocktwits about Eos Energy was in the ‘neutral’ territory at the time of writing, compared with ‘bearish’ a day ago.

“This is the kind of raise a company does before entering a major revenue ramp,” one trader said after advising others not to panic.

The company also said the Department of Energy, which granted a $303 million loan last year for its manufacturing facilities, approved the offerings. The firm posted a record third-quarter revenue of $30.5 million earlier this month. Eos Energy also added $3.8 billion to its commercial pipeline during the quarter, bringing the total to $22.6 billion, representing 91 gigawatt/hour of energy storage capacity.

Eos Energy stock has more than doubled this year and risen over sixfold in the past 12 months.

Also See: Kraken Scores $20B Valuation After Latest Fundraise, Leaving Gemini And Bullish Miles Behind

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)