Advertisement|Remove ads.

Why Did FuelCell Stock Rocket 35% Today?

- FueCell's fourth-quarter earnings received a boost from strong demand for electricity amidst the global AI push.

- The company’s fourth-quarter revenue surged past estimates.

- It reported a narrower loss in the quarter compared to the year-ago period.

FuelCell Energy (FCEL) shares jumped 35% at the opening bell on Thursday after its fourth quarter revenue surged past analyst estimates, helped by increasing demand for electricity and data center projects amidst a global AI push, while its loss came in narrower than expected.

As corporations and governments continue to adopt and implement artificial intelligence in their daily operations, the demand for data centers and electricity to keep them running has remained high, helping firms like FuelCell, which provide fuel cell power plants that generate clean electricity for businesses and communities.

Q4 Report

The company reported fourth-quarter (Q4) revenue of $55 million, well above analyst estimates of $47.2 million, according to data from Fiscal.ai.

“We believe that our fourth quarter performance and ongoing cost reductions have positioned us well to meet the accelerating demand for electricity and data center projects in the U.S. and internationally,” said Jason Few, President and CEO of FuelCell Energy.

The company also posted an adjusted net loss attributable to common stockholders of $29.8 million in the quarter, compared to an adjusted net loss of $35.3 million in the fourth quarter of fiscal 2024. It reported an adjusted net loss per share of $0.83 compared to analysts’ expectation of a loss of $1.09 per share.

How Did Stocktwits Users React?

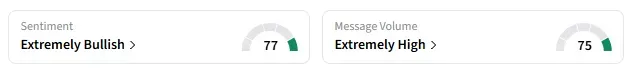

On Stocktwits, the retail sentiment around FCEL remained in ‘extremely bullish’ territory, and message volume remained ‘extremely high’. The stock is among the top 10 trending tickers on Stocktwits.

One of the users on Stocktwits sounded “super bullish” on the stock after its earnings report.

FuelCell Energy shares have declined nearly 24% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)