Advertisement|Remove ads.

Why Did Tower Semiconductor’s Stock Surge 18% Today?

- Tower’s CEO, Russell Ellwanger, highlighted growth across the company’s radio frequency (RF) infrastructure, silicon photonics, and silicon germanium platforms.

- RF infrastructure business jumped to $107 million in Q3, or 27% of total revenue.

- Additionally, Tower announced a $300 million investment aimed at expanding capacity.

Tower Semiconductor (TSEM) stock surged over 18% on Monday, after the company announced strong third-quarter earnings, reporting a rise in revenue and profit driven by strength across its core technology platforms.

The company reported a third-quarter (Q3) revenue of $396 million, a 6% year-on-year increase, and an adjusted earnings per share (EPS) of $0.55. Both revenue and EPS surpassed the analysts’ consensus estimate of $394.9 million and $0.54, respectively, according to Fiscal AI data.

CEO Remarks

Tower’s CEO, Russell Ellwanger, highlighted growth across the company’s radio frequency (RF) infrastructure, silicon photonics, and silicon germanium platforms, underscoring their importance as strategic growth drivers for the company.

“This significant expansion reflects the strong customer adoption of our advanced technology and validate our strategic investments in these markets.”

-Russell Ellwanger, CEO, Tower Semiconductor

Ellwagner said Tower’s RF infrastructure revenue jumped to $107 million, or 27% of total corporate revenue. For the full year, the company anticipates a 75% increase in RF-related revenue, supported by an increased demand for its advanced semiconductor solutions.

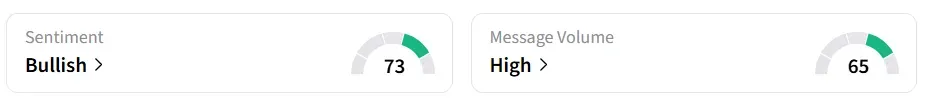

On Stocktwits, retail sentiment around Tower Semiconductor stock remained in ‘bullish’ territory. Message volume improved to ‘high’ from ‘normal’ levels in 24 hours.

Strong Demand For Silicon Photonics

The sharp rise in silicon photonics sales stems from stronger-than-expected demand for 1.6-terabit and RAP products, combined with continued growth in 400G and 800G solutions. Tower expects this segment to more than double compared to 2024 levels, reaching over $105 million for the full year.

The company anticipates shipping several thousand more wafers in the fourth quarter as demand continues to build. In parallel, Tower is progressing toward qualification at its Fab 2 plant in Israel, where it anticipates commencing initial production shipments in early 2026.

Additionally, Tower announced a $300 million investment aimed at expanding capacity and advancing next-generation manufacturing technologies.

TSEM stock has gained over 92% in 2025 and over 112% in the last 12 months.

Also See: Rubrik, AWS Deal Aims To Enhance Cybersecurity With AI-Powered Protection

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)