Advertisement|Remove ads.

Why Is AMZN Rising In Premarket Today?

- Amazon shares rebounded in Tuesday’s premarket session, after a modest slide the previous day.

- AWS bagged a $581 million contract from the U.S. Air Force.

- Investors review their positions ahead of the company’s fourth quarter report next Thursday.

Amazon.com, Inc’s shares gained 0.6% in early premarket trading on Tuesday, drawing momentum from a cloud contract win and a positive analyst action.

Amazon Web Services (AWS) said Monday that it was awarded a $581 million contract under the U.S. Air Force’s Cloud One Program. Last week, Microsoft’s Azure was selected for similar work at a cost of $170 million.

Cloud One is an enterprise-level cloud computing platform and service, managed by the Department of the Air Force, for communication and cloud capabilities supporting mission applications across the U.S. military.

Meanwhile, Roth Capital raised its price target on AMZN to $295 from $270, while keeping its ‘Buy’ rating, according to the investor note summary posted on The Fly on Monday.

Wall Street analysts are underestimating margin relief from Q4 layoffs and likely additional layoffs in Q1 of FY26, the investment research firm noted, adding that Amazon is its top Mega Cap for the first half of this year. Reuters reported last week, citing sources, that Amazon is preparing to cut around 30,000 corporate roles, on top of roughly 14,000 white-collar layoffs the company announced in October.

Heading into Amazon’s quarterly report next week, Roth Capital believes the Trainium 3 launch, Rufus's impact on commerce conversions, and greater color on the AWS-OpenAI relationship could boost sentiment toward Amazon.

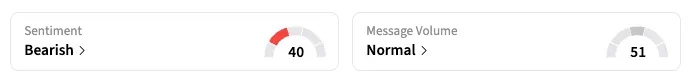

On Stocktwits, retail sentiment for AMZN shifted to ‘bearish’ as of early Tuesday, from ‘neutral’ the previous day, amid ‘normal’ message volume.

Despite analysts overwhelmingly recommending buying AMZN, investors are displeased with the stock’s recent poor performance. Shares gained a modest 5.2% over 2025 and are up 3.3% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Is Silver 'Not A Meme' Now? Analyst Likens Metal To GameStop As Volatility, ETF Volumes Explode

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)