Advertisement|Remove ads.

Why Is AMZN Stock Down In Premarket Today?

- Amazon said it would lay off 16,000 workers.

- AMZN stock is also weighed by reports of its planned investment in OpenAI and by the sell-off in Microsoft stock amid the soft performance of its Azure cloud unit.

- Amazon will report its fourth-quarter results on Feb. 5.

Amazon.com, Inc.’s shares dropped 1.5% in early premarket trading on Friday, retreating from strong gains the previous day on significant layoff news.

Stock gained 4.7% on Thursday, after Amazon announced that it would lay off 16,000 workers – its most significant retrenchment since the 12,000 job cuts last October – to reduce middle-layer and drive up organizational efficiency.

Meanwhile, a series of other developments appears to be weighing the stock in the premarket. OpenAI is reportedly considering a hefty investment of up to $50 billion in the ChatGPT maker, a move that might raise eyebrows at a time when Big Tech’s incredible AI spending has come under scrutiny.

MSFT Selloff Weighs

Meanwhile, Amazon’s chief rival in the cloud space, Microsoft, faced its worst stock drop in six years on Thursday due to what investors perceived as a soft performance of Azure.

Sales of Azure grew 39% in the December quarter, a percentage point less than the sequentially prior quarter.

Microsoft also reported a record $37.5 billion in capital expenditures in its fiscal second quarter and said the figure could rise over time, partly due to the rising cost of memory chips.

Focus Shifts To Earnings

Amazon is scheduled to report its quarterly results next Thursday. Analysts expect revenue to rise 12.5% to $211 billion and adjusted profit to increase by over 4% to $1.94 per share.

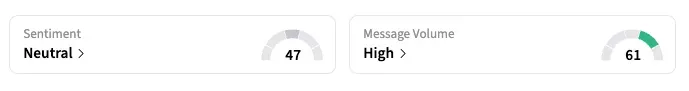

Retail investors appear uncertain ahead of the report. Stocktwits sentiment for AMZN has remained in the ‘neutral’ zone in the past week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vivek_ramaswamy_OG_jpg_76e0d292d4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238607147_1_jpg_58c21314a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Serve_jpg_db54b211a2.webp)