Advertisement|Remove ads.

Why Is AST Spacemobile Stock Sliding Over 6% Premarket Today?

- The company has about 361.4 million outstanding shares and a market capitalization of $28.4 billion.

- The satellite broadband provider’s convertible bond offering comes days after the stock crossed the $100-mark for the first time.

- AST SpaceMobile is developing a space-based cellular broadband network that connects directly to regular mobile phones without any modifications.

AST Spacemobile (ASTS) stock declined over 6% in early premarket trading on Wednesday after the company announced a proposed offering of $850 million worth of convertible bonds.

In addition to the proposed offering of the notes due 2036, the satellite broadband provider will also allow the underwriters to buy up to an additional $150 million aggregate principal amount of notes.

The company, a direct competitor of Starlink, has about 361.4 million outstanding shares and a market capitalization of $28.4 billion. Separately, the company also filed to buy $50 million worth of its convertible bonds due 2032.

Why Is ASTS Raising Funds?

AST Spacemobile said to use net offering proceeds for general purposes, including funding deployment of its worldwide constellation of satellites in anticipation of adding incremental strategic markets for its Spacemobile service.

AST SpaceMobile is developing a space-based cellular broadband network that connects directly to regular mobile phones without any modifications. The system relies on the company’s broad patent and IP portfolio and is intended to serve both commercial and government users.

On Oct. 8, the company entered into a major agreement with Verizon Communications Inc. (VZ) to offer direct-to-device cellular service to Verizon customers beginning in 2026.

What Is Retail Thinking?

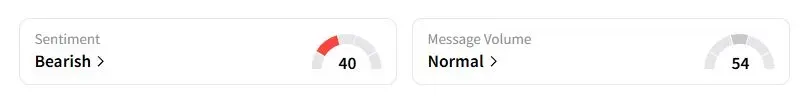

Retail sentiment on Stocktwits about AST Spacemobile stock was in the ‘bearish’ territory at the time of writing.

Yet, the company’s latest move was finding support among some sections of traders. “Everyone needs to understand they need a lot of money to build these satellites. So management is doing this extremely efficiently with as little dilution as possible,” one user wrote on Stocktwits.

“I’m going to keep the faith and expect a partnership or contract announcement in the next few days. I’ll buy this dip with what few available funds I have,” another user said.

AST Spacemobile stock has more than tripled this year. It is currently trading at $73.40 as of Tuesday’s close, below the over $100 mark it hit earlier this month amid valuation concerns.

Also See: Bitcoin Hovers Around $108K After Trump’s Cautious Tone On US-China Trade Deal

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246131051_jpg_78a656bc06.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_gravity_jpg_173d7fb4ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)