Advertisement|Remove ads.

Why Is Booz Allen Hamilton Stock Tumbling Today?

- Treasury Secretary Scott Bessent said Booz Allen failed to implement adequate safeguards to protect sensitive data, including the confidential taxpayer information.

- The department said that Booz Allen Hamilton’s employee, Charles Edward Littlejohn, had stolen and leaked confidential tax returns and information of hundreds of thousands of taxpayers in the U.S.

- In January 2024, Littlejohn was sentenced to five years in prison for leaking thousands of confidential U.S. tax returns to media organizations, including those of President Trump.

Booz Allen Hamilton Holding (BAH) stock plummeted nearly 10% on Monday after the U.S. Treasury Department announced that it had canceled all its contracts with the company for failure to protect sensitive data.

According to a release, the department has cancelled the existing 31 contracts with the Virginia-based company, amounting to about $4.8 million in annual spending, and $21 million in total obligations.

“President Trump has entrusted his cabinet to root out waste, fraud, and abuse, and canceling these contracts is an essential step to increasing Americans’ trust in government,” said Treasury Secretary Scott Bessent.

“Booz Allen failed to implement adequate safeguards to protect sensitive data, including the confidential taxpayer information it had access to through its contracts with the Internal Revenue Service,” Bessent added.

What Are The Accusations?

The department said that Booz Allen Hamilton’s employee, Charles Edward Littlejohn, had stolen and leaked confidential tax returns and information of hundreds of thousands of taxpayers in the U.S.

The U.S. Internal Revenue Service found that Littlejohn’s data breach had impacted about 406,000 taxpayers in the country. Littlejohn has pled guilty to felony charges for disclosing confidential tax information without authorization.

In January 2024, Littlejohn, a former IRS contractor, was sentenced to five years in prison for leaking thousands of confidential U.S. tax returns to media organizations.

According to court records, Littlejohn exploited his access to internal databases to secretly obtain tax information linked to high-ranking government officials and thousands of wealthy individuals. He admitted to leaking U.S. President Donald Trump’s tax records to The New York Times.

“Today’s sentence sends a strong message that those who violate laws intended to protect sensitive tax information will face significant punishment,” Acting Assistant Attorney General Nicole M. Argentieri of the Justice Department’s Criminal Division had said at the time.

Quarterly Report

Last week, Booz Allen Hamilton reported third-quarter (Q3) 2026 results. The company reported revenue of $2.6 billion, falling below analysts’ expectations and 10.2% lower year-on-year.

The company attributed the revenue decline to a slowed procurement and funding environment, including the government shutdown.

How Did Stocktwits Users React?

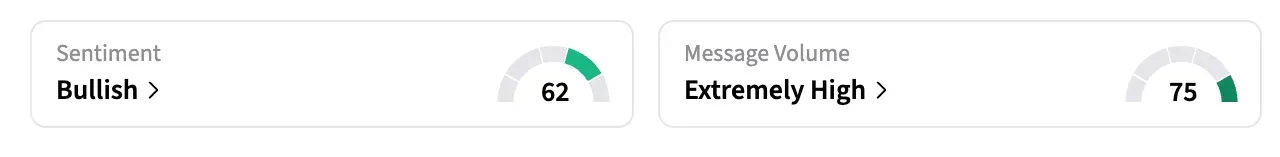

On Stocktwits, retail sentiment around BAH stock remained in the ‘bullish’ territory over the past 24 hours amid ‘extremely high’ message volumes.

Shares of BAH have declined nearly 32% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)