Advertisement|Remove ads.

Why Is DLocal Stock Gaining Premarket Today?

DLocal stock (DLO) rose 1.3% in premarket trading on Tuesday after Goldman Sachs turned bullish on the payments firm.

According to The Fly, Goldman Sachs analysts upgraded the stock to “buy” from “neutral” and raised the price target to $19, up from $12. The new price target implies a 33% upside compared to the stock’s previous closing price.

Goldman analysts reportedly expressed confidence that the Montevideo, Uruguay-based firm can deliver 20%-plus EBITDA growth in the mid-term. DLocal will report "solid" payment volume growth through 2027, driven by geographical diversification, market share gains with existing merchants, and the attraction of new merchants, such as stablecoin operators, according to the analyst.

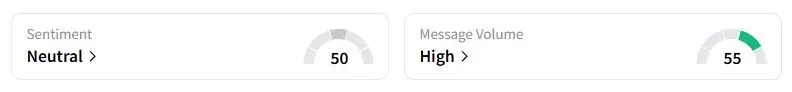

Retail sentiment on Stocktwits about DLocal was in the ‘neutral’ territory at the time of writing.

In August, DLocal topped second-quarter revenue estimates on the back of strong volume growth, driven by a recovery in Brazil and Mexico, a substantial increase in Argentina, and notable contributions from Turkey, South Africa, and Pakistan.

The company also raised its projections for total payment volume growth in 2025 to a range of 40% to 50%, compared with its earlier forecast of between 35% and 45%. It also raised its revenue projections to a range of 30% to 40%, compared with the earlier forecast of 25% to 35%.

Brushing aside any impact of stablecoins on the company, CEO Pedro Arnt said at the time that DLocal already allows its merchants to settle transactions in stablecoins, thereby quickening settlement times of cross-border flows. In a bid to gain a share in the remittance market, DLocal launched a partnership with Western Union in September to enable digital payment methods on the money transfer service provider’s online platforms in Latin America.

DLocal stock has gained nearly 31% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)