Advertisement|Remove ads.

Goldman Sachs Makes $1B Play For Venture Capital Growth With Industry Ventures Deal Ahead Of Q3 Earnings

Goldman Sachs stock (GS) edged lower in early premarket trading on Tuesday ahead of the scheduled release of the bank’s quarterly earnings report.

On Monday, after the markets closed, Goldman said it will buy venture capital firm Industry Ventures, which currently manages $7 billion of assets under supervision (AUS). The firm has one of the largest portfolios of venture capital partnerships from the seed stage to the late-stage growth stage in the United States, Goldman said.

“Industry Ventures pioneered venture secondary investing and early-stage hybrid funds, areas that are rapidly expanding as companies stay private longer and investors seek new forms of liquidity,” said David Solomon, Goldman’s CEO.

Industry Ventures will sit inside Goldman’s external manager platform, the External Investing Group (XIG), which has over $450 billion in AUS, the bank noted. Goldman will shell out $665 million in cash and equity payable at closing, with an additional $300 million in payments contingent upon certain conditions.

“The acquisition will expand Goldman Sachs’ ability to be a better solutions provider to technology entrepreneurs,” the firm said.

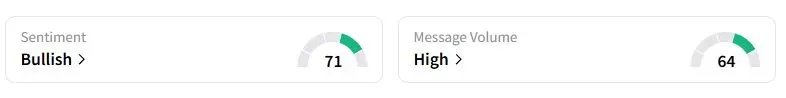

Retail sentiment on Stocktwits about Goldman was in the ‘bullish’ territory at the time of writing.

On Tuesday, Wall Street expects Goldman to post earnings of $10.59 per share on revenue of $14.07 billion, according to Fiscal.ai data. The lender has topped quarterly profit estimates in all four previous quarters.

Earlier this month, Mizuho analysts noted that the bank has robust operating leverage and is positioned to benefit from the recovery in capital markets.

Dealmaking has rebounded this year, as the Trump administration has adopted a more favorable approach to mergers. The third quarter was also the busiest three-month period this year for new listings, as more firms went public amid soaring stock market and rate hike bets. According to Dealogic data, U.S. mergers and acquisitions reached $665.6 billion in the third quarter of 2024, far exceeding the $403.1 billion in the same period last year.

Additionally, the volatility caused by the uncertain policies of the Trump administration is also expected to bolster Goldman’s earnings.

“Trading operations have capitalized on market volatility, particularly in fixed income and currencies. Banks with strong trading franchises have been able to generate substantial revenues from client flows and proprietary positioning,” IG Bank analysts wrote.

Goldman Sachs shares have gained 35.8% this year, outperforming the 8.4% gains of the Financial Select Sector SPDR Fund.

Also See: Bitcoin Slips Below $112,000 — Gold Bull Peter Schiff Warns Of ‘Rude Awakening’ For Investors

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)