Advertisement|Remove ads.

Why Is ImmunityBio Stock Back In Retail Spotlight Today?

- ImmunityBio reported lasting responses in a blood cancer study.

- The company expects a U.S. filing for its bladder cancer program by the end of 2026.

- Saudi regulators granted new approvals for Anktiva in bladder and lung cancer.

ImmunityBio Inc. shares drew heightened attention on Tuesday after the company disclosed multiple updates last week spanning late-stage clinical data, regulatory approvals and trial enrollment progress across its cancer treatment pipeline.

Durable Responses In Blood Cancer Study

On Friday, ImmunityBio shared updated results from its ongoing QUILT-106 study in patients with Waldenstrom lymphoma, a type of blood cancer. The company said patients showed complete responses lasting seven and 15 months after finishing treatment, with no further therapy needed.

All four patients enrolled in the study remain under disease control, including two who had extensive cancer at the start and responded after just four doses. The treatment was delivered entirely in outpatient settings and did not involve chemotherapy.

Enrollment Nears Completion In Bladder Cancer Study

Additionally, on Friday, ImmunityBio provided an update on a separate bladder cancer study evaluating Anktiva, the company’s immune-based therapy, in patients who had not previously received BCG (Bacillus Calmette-Guerin) treatment.

The company said enrollment in the trial has passed 85%, with full enrollment expected by the second quarter of 2026. Based on the current pace, ImmunityBio said it expects to submit a biologics license application to the U.S. Food and Drug Administration (FDA) by the end of 2026.

An earlier FDA-requested review showed patients receiving Anktiva alongside standard treatment remained cancer-free longer than those given standard treatment alone, with higher response rates seen at both six and nine months.

Saudi FDA Grants Accelerated Approvals For Anktiva

Last week, Saudi health regulators approved Anktiva, used with standard bladder cancer therapy, for patients whose disease no longer responds to earlier treatment. The approval adds to existing clearances in the U.S. and U.K., as well as conditional approval in the European Union.

ImmunityBio said it plans to open a regional office in Saudi Arabia and will work with Biopharma Cigalah to distribute the treatment across the Middle East and North Africa.

On the same day, Saudi regulators also approved Anktiva for use with immune-based medicines in patients with advanced lung cancer whose disease had continued to progress after prior treatment. The company said the decision was supported by clinical data showing improved immune response and links to longer survival.

ImmunityBio added that a follow-up lung cancer study is currently enrolling patients.

How Did Stocktwits Users React?

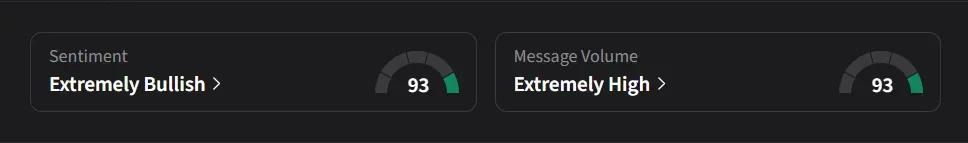

On Stocktwits, retail sentiment for ImmunityBio was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the recent regulatory developments added to optimism around the company’s outlook, adding, “Perhaps we won’t need to wait until 2030 to see a triple-digit stock price! 2026 is really off to a great start!!”

Another user said a potential first-line approval in the U.S. could significantly expand the drug’s commercial reach, adding that sales could rise 3x to 5x current levels, which the user described as highly likely.

ImmunityBio’s stock has risen 82% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)