Advertisement|Remove ads.

Why Is IREN Stock Falling Today?

IREN stock saw a bearish shift in rating from JPMorgan Chase & Co., which downgraded the stock to ‘Underweight’ from ‘Neutral’ amid questions about the sustainability of its recent valuation surge, according to TheFly.

Analyst Reginald Smith, however, raised the price target on the stock to $24 from $16. IREN’s valuation appears to reflect expectations around a massive colocation agreement exceeding one gigawatt at its Sweetwater site in Texas.

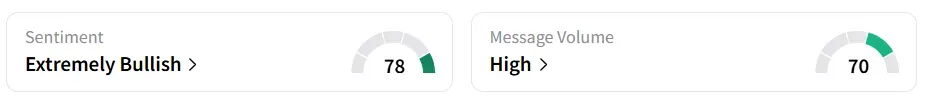

Following the rating update, IREN stock traded over 6% lower in Friday’s premarket and was the second-most trending equity ticker on Stocktwits. Retail sentiment around the stock improved to ‘extremely bullish’ territory from ‘bullish’ amid ‘high’ message volume levels.

The stock saw a 134% increase in user message count over the past week. Stocktwits users appeared to remain optimistic about the company despite the downgrade.

If finalized, the colocation agreement would represent a historic level of capital investment and operational scale in the bitcoin mining and high-performance computing sector, said the analyst.

JPMorgan acknowledges the potential for this scale of growth to materialize in time. However, the firm believes that the risks currently outweigh the potential rewards. The reassessment comes as mining economics continue to shift, with fluctuations in bitcoin prices and upside from high-performance computing (HPC).

On September 23, IREN said it has doubled its AI Cloud capacity to a total of 23,000 GPUs (graphic processing units), supporting the company’s goal of achieving more than $500 million in annualized AI Cloud revenue by the first quarter of 2026.

IREN stock has gained over 371% in 2025 and 407% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)