Advertisement|Remove ads.

Why Is MP Materials Stock Gaining Over 3% Premarket?

- Deutsche Bank analysts reportedly stated that MP Materials holds a unique position as the only fully integrated rare earth company in the Western world.

- The brokerage also reportedly cited clear growth drivers for MP Materials, including volume expansion through heavy refining, magnet production, and recycling capabilities.

- MP CEO Jim Litinsky was upbeat about the company’s growth prospects last week and referred to the tussle between the U.S. and China as ‘Cold War 2.0’.

MP Materials' stock rose over 3% in premarket trading after Deutsche Bank turned bullish about the rare earth miner.

According to investing.com, the brokerage raised MP stock's rating from ‘Hold’ to ‘Buy’ and increased its price target to $71 from $68. The new price target implied a 21.1% upside compared to the stock’s previous closing price.

What Did The Analysts Say?

Deutsche Bank analysts reportedly stated that MP Materials holds a unique position as the only fully integrated rare earth company in the Western world, with backing from the U.S. government, including an elevated pricing floor of $110 per kilogram.

The brokerage also cited clear growth drivers for MP Materials, including volume expansion through heavy refining, magnet production, and recycling capabilities, which reportedly positioned the company strategically in the rare earth market.

The investment firm also saw potential upside to future earnings, depending on the progress of the refinery and possible optimization of the company’s mine plan at the Mountain Pass facility. However, it viewed these as medium to long-term opportunities.

What Are Stocktwits Users Thinking?

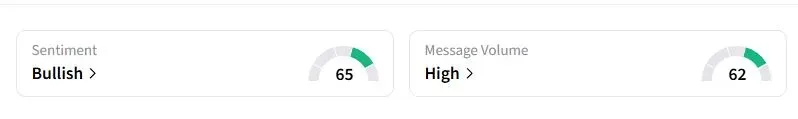

Retail sentiment on Stocktwits about MP was in the ‘bullish’ territory at the time of writing, compared with ‘bearish’ a week ago. The stock was the top trending ticker on the social media platform.

One trader said MP is set to shine this week.

The latest upgrade follows its earnings report last week. The Las Vegas-based company reported a net loss of $41.8 million, or $0.24 per share, for the third quarter on Thursday, compared to a loss of $11.2 million, or $0.16 per share, a year earlier, as it grappled with the loss of revenue from the stoppage of sales of rare earth concentrate during the quarter.

In previous quarters, these sales made up for most of the company's revenue. However, a July investment agreement with the U.S. military prevented any further shipments. However, MP CEO Jim Litinsky was upbeat about the company’s growth prospects last week and referred to the tussle between the U.S. and China as ‘Cold War 2.0’.

"Economic might itself, expressed through control of critical materials, advanced technologies, and the supply chains that sustain them, has become the decisive measure of national power," he said.

The company also said it expects commercial magnet production from its Texas site to begin by the end of the year. MP stock has more than tripled this year after the company received backing from the U.S. Department of Defense alongside Apple Inc.

Also See: Rocket Lab Q3 Earnings Preview: Retail Bulls Bet On Neutron Launch, Stronger Margins

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Service_Now_logo_jpg_c0da5348e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_doordash_jpg_6a0ffd4b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)