Advertisement|Remove ads.

Why Is RBLX Stock Up In Premarket Today?

- Wood, who has been loading up on RBLX stock over the past few months, bought nearly $10 million on Monday.

- Last week, Roblox reported upbeat Q4 results, which lifted shares.

- RBLX stock is still down about 50% from its July peak.

Roblox Corp. shares rose 0.4% in early premarket trading on Tuesday, after Cathie Wood’s ARK Invest disclosed that it acquired more shares of the video gaming company.

The investment firm bought 145,603 shares across its ARKK, ARKW, and ARKF funds, totaling $9.7 million, over trades made on Monday.

Wood has been loading up Roblox stock since November. Her funds purchased approximately $8 million in shares then and again in February.

Roblox stock has slid substantially in the last eight months, just before a relief rally following upbeat quarterly results last Thursday.

The company’s fourth-quarter revenue increased 43% to $1.4 billion, while bookings rose 63% to $2.2 billion and topped analysts' expectations of $2.09 billion, driven by a combination of user growth and monetization gains.

Roblox attributed gains to last year’s release, such as “Steal A Brainrot” and “Grow A Garden”, as well as its other existing games and said it is looking to expand offerings to capture older audiences.

Roblox shares have jumped by over 20% in the last two sessions; however, they are still down about 50% from their peak on Jul. 31.

Earlier in the week, Roth Capital upgraded its rating on the stock to ‘Buy’ from ‘Neutral.’

Currently, 25 of 35 analysts have a ‘Buy’ or higher rating on the shares, nine rate it ‘Hold,’ and one rates it ‘Sell,’ according to Koyfin data. Their average price target of $112.78 implies a 43% upside to the stock’s last close.

Like other tech stocks, Roblox's move is part of a broader market rebound following a broad-based selloff.

The markets entered a downcycle recently, triggered by concerns about heavy AI-related spending and the risk that AI tools could upend the status quo by eroding demand for some legacy software.

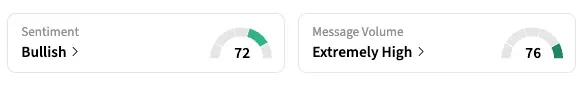

On Stocktwits, sentiment for RBLX shifted to ‘bullish’ as of early Tuesday, from ‘extremely bullish’ the prior day.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Kyndryl Blowup: JPMorgan Double Downgrades Stock After ‘Stunning’ CFO Exit, Accounting Review

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243817419_jpg_fd782b2997.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191224409_jpg_fd3e69e2d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229305833_jpg_f9b80a181a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_9782f9c21f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_AES_July_a52bf06b47.webp)