Advertisement|Remove ads.

RGC Stock Gains 20% Pre-Market — Retail Says Shorts Are In ‘Huge Trouble’

- Regencell stated in an October SEC filing that it may be required to curtail or discontinue its operations in the future.

- In the 2025 and 2024 fiscal years, Regencell reported a net loss of $3.58 million and $4.36 million, respectively.

- The company had indicated that it anticipates incurring additional losses before realizing any revenues.

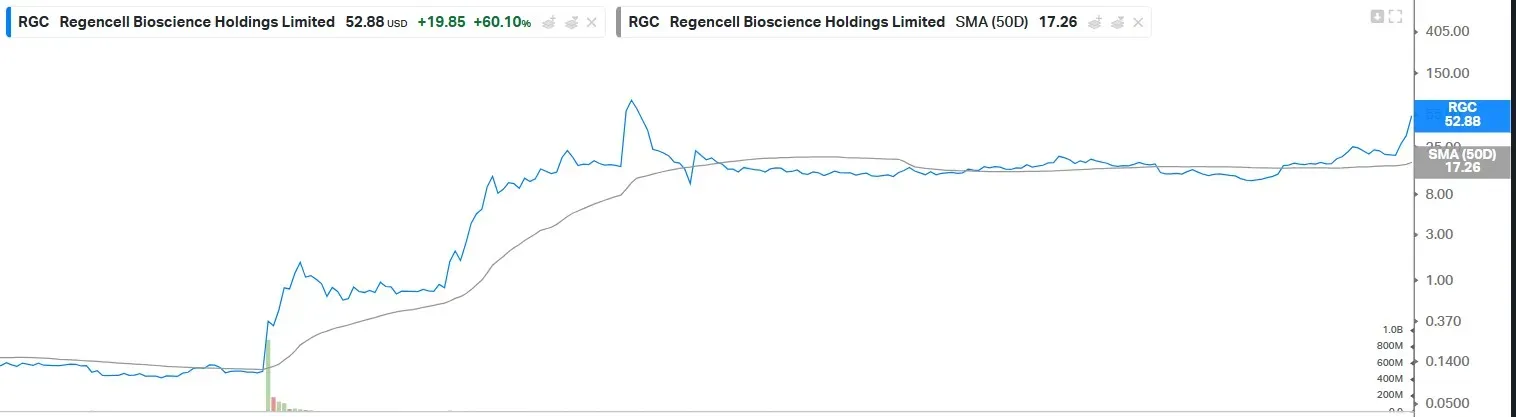

Shares of Regencell Bioscience Holdings (RGC) have been drawing significant investor attention after gaining nearly 152% in the first four trading sessions of 2026.

Following Wednesday’s relentless rally, the shares continued to climb in Thursday’s pre-market trade as well, rising by over 20% at the time of writing.

While the bulk of the recent surge has come in 2026, RGC stock is still up nearly 218% since October 31, despite the company flagging a “substantial doubt” about its ability to continue as a going concern.

How Did Stocktwits Users React?

Retail sentiment on Stocktwits regarding Regencell Bioscience was trending in the ‘bullish’ territory at the time of writing.

One bullish user thinks that traders shorting the stock are in “huge trouble now.”

Another user said they treat it as a momentum-only stock.

RGC’s Going Concern Flag

In a filing with the U.S. Securities and Exchange Commission in October 2025, the company said that there is a “substantial doubt” about its ability to continue as a going concern.

It added that this indicates the company may be required to curtail or discontinue its operations in the future.

“If we discontinue our operations, you may lose all of your investment,” Regencell said, adding that it anticipates incurring additional losses before realizing any revenues. In the 2025 and 2024 fiscal years, Regencell reported a net loss of $3.58 million and $4.36 million, respectively.

Regencell is an early-stage company focusing on research, development, and commercialization of Traditional Chinese Medicine for the treatment of neurocognitive disorders and degeneration, specifically Attention Deficit Hyperactivity Disorder and Autism Spectrum Disorder.

RGC stock is up 152% year-to-date.

Also See: HELE Stock Slides Pre-market As Tariff Headwinds Trigger FY26 Earnings Guidance Cut

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_joblessclaims_resized_jpg_b395b1ff15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cme_resized_5dbde36693.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)