Advertisement|Remove ads.

Why Is UUUU Stock Rising Today?

- The company’s uranium production in Pinyon Plain Mine in Arizona and La Sal Complex in Utah beat the top end of previously reported guidance by about 11%.

- Energy Fuels now expects to sell 360,000 pounds of finished triuranium octoxide in the fourth quarter of 2025, more than double from 160,000 pounds expected earlier.

- The rare earths company also announced the completion of two long-term uranium sales contracts with U.S. nuclear power-generating companies.

Energy Fuels Inc. (UUUU) shares climbed over 5% in Monday’s premarket trade after the company announced that its finished uranium production, mined uranium ore production, and uranium concentrate sales for FY 2025 exceeded previously announced guidance.

The company’s Pinyon Plain Mine in Arizona and La Sal Complex in Utah mined over 1.6 million pounds of uranium in 2025, beating the top end of previously reported guidance by about 11%.

Meanwhile, its White Mesa Mill in Utah produced over one million pounds of finished triuranium octoxide, a uranium compound, in 2025, also exceeding the top end of previously reported guidance.

Guidance Update

Energy Fuels said it expects to sell 360,000 pounds of triuranium octoxide in the fourth-quarter (Q4) of 2025, more than double the 160,000 pounds expected earlier and a 50% increase from third-quarter (Q3) 2025 levels. Total gross uranium sales revenue for Q4 2025 is expected to be about $27 million.

Energy Fuels also announced the completion of two long-term uranium sales contracts with U.S. nuclear power generating companies that are expected to contribute to the company’s deliveries between 2027 and 2032.

Pursuant to these contracts, Energy Fuels expects sales of 780,000 to 880,000 pounds of triuranium octoxide in 2026, and anticipates additional sales in the spot and term markets. For 2027 to 2032, the company’s current portfolio of six long-term contracts is estimated to deliver 2.41 to 4.41 million pounds of triuranium octoxide.

Energy Fuels also expects its cost of goods sold to start declining in the first-quarter (Q1) of 2026 as low-cost Pinyon Plain uranium is added to its inventory.

Rare Earth Focus

Rare earth elements and critical metals have been in focus this year after China restricted supply following President Donald Trump’s export tariffs. China controls roughly 70% of global mining and nearly 90% of processing.

As a result, there has been a renewed interest in companies positioned to supply critical materials outside China. Meanwhile, demand for rare earth minerals has been climbing in the U.S. and worldwide as crucial components in EV battery production.

How Did Stocktwits Users React?

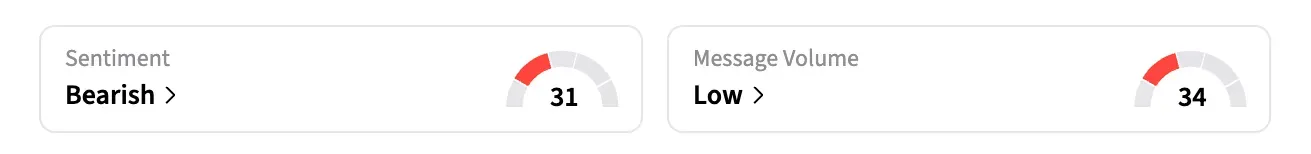

On Stocktwits, retail sentiment around UUUU shares trended in the ‘bearish’ territory amid ‘low’ message levels over the past day.

Shares of UUUU are up over 186% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)