Advertisement|Remove ads.

NOW Stock Falls 9% After Q4 Beat: Why Have Analysts Cut Price Targets?

- Canaccord reduced its price target to $200 from $224, maintaining a ‘Buy’ rating.

- KeyBanc said ServiceNow’s projected organic subscription growth of 18.5% to 19% for 2026 is insufficient to completely ease investor concerns.

- JPMorgan also trimmed its price target and emphasized that the company’s cost-efficiency measures are resonating positively amid challenging market conditions.

ServiceNow Inc. (NOW) has seen a flurry of price target adjustments from major Wall Street firms following its fourth-quarter (Q4) earnings.

Despite delivering strong fourth-quarter results, the stock’s valuation and growth outlook have prompted cautious guidance from several firms. The company reported a Q4 revenue of $3.568 billion and earnings per share (EPS) of $0.92, both exceeding the analysts’ consensus estimates of $3.529 billion and $0.87, respectively, according to FiscalAI data.

ServiceNow stock traded over 9% lower in Thursday’s premarket.

Analyst Rationale

Canaccord reduced its price target to $200 from $224, maintaining a ‘Buy’ rating. The firm described Q4 as solid, noting that results were comparable or slightly better than the previous quarter, which had already been viewed positively, yet the stock’s recent pullback has made it appear more attractive.

Similarly, KeyBanc lowered its price target to $115 from $155, keeping an ‘Overweight’ rating. The firm cited ServiceNow’s projected organic subscription growth of 18.5% to 19% for 2026 as insufficient to completely ease investor concerns, signaling caution despite decent underlying performance.

JPMorgan also trimmed its target to $195 from $215, maintaining an ‘Overweight’ stance. The firm highlighted ServiceNow’s Q4 beat and emphasized that the company’s cost-efficiency measures are resonating positively amid challenging market conditions, providing confidence in its operational discipline even during slower-growth periods.

How Are Retail Traders Reacting

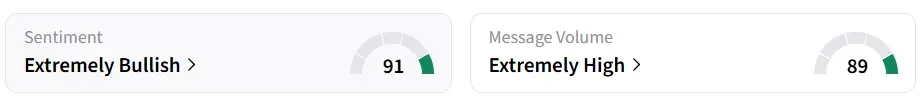

On Stocktwits, retail sentiment around the stock changed to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

A Stocktwits user suggested buying the stock when the price is lower.

Another bullish user said that AI will enhance the operations of companies like ServiceNow.

NOW stock has declined by over 43% in the last 12 months.

Also See: Meta Q4 Earnings Beat Fuels New Price Target Hikes On AI, Ad Growth Optimism

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_lockheed_martin_resized_9668fa4b7a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1041464080_jpg_a64441a11c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_powell_2017_jpg_0255a21326.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2225993035_jpg_f4a10b77ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Gold_Silver_jpg_c77de4fb71.webp)