Advertisement|Remove ads.

Why This Natural Gas Stock Is Drawing Maximum Retail Sentiment Today

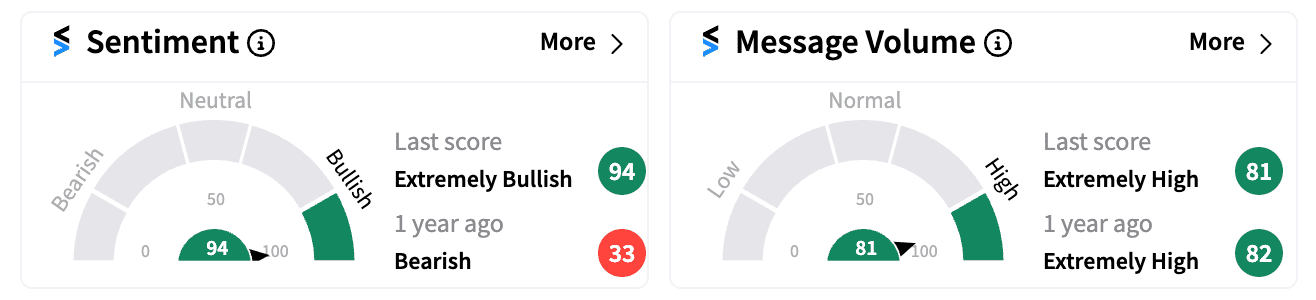

Hold onto your hats, natural gas bulls! DT Midstream, a midstream pipeline operator, might be your new favorite play, at least according to retail investors on Stocktwits. Despite a nearly flat day in the market on Wednesday, sentiment for DTM is through the roof – a scorching hot 94/100. Message volumes are also extremely high (82/100), indicating growing discussion.

So, what's fueling the retail fire? A recent analyst upgrade seems to be the spark. Barclays raised its price target on DT Midstream to $72 from $66, and maintained an "Overweight" rating. The analyst believes midstream companies like DT Midstream are perfectly positioned to capitalize on growing needs for reliable infrastructure in the second half of 2024 amid political volatility and price uncertainty surrounding natural gas.

While natural gas liquids pricing might stay weak, the fee-based nature of midstream earnings means volume growth will likely outweigh this headwind, according to the firm. This aligns with the current market situation – U.S. gas prices have fallen dramatically after a mild winter left stockpiles high and production steady, per Bloomberg.

But wait, there's more. Wells Fargo also jumped on the bullish bandwagon last month, upgrading DT Midstream (along with peers Kinder Morgan and Williams) to "Overweight" with a price target of $77. The reasoning? Artificial intelligence, reshoring, and liquefied natural gas are all fueling a long-term rise in gas demand. The firm even predicts a multiple expansion for midstream stocks, with the average multiple increasing from 9.5x to 10.5x.

This bullish outlook seems to resonate with retail investors for now as DT Midstream already trades at all-time highs and boasts a near 30% YTD gain.

With analysts backing the play and the potential for continued growth, DT Midstream could be a hot commodity with retail investors for some time to come. At least that’s the current sentiment read on Stocktwits.

Image by Vilius Kukanauskas from Pixabay

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_chipset_representative_image_resized_5fd29fe377.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Beyond_Meat_jpg_282a2e2ef0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235360937_jpg_cc1fa4f58f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nextera_resized_jpg_7b65665ed5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/resized_lip_bu_tan_intel_ceo_jpg_3a809518df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/20250320041134_sensex_nifty-marketup_sensexup-Niftyup.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)