Advertisement|Remove ads.

Citi Cuts Near-Term Gold Price Forecast To $3,800 Citing Shift In Geopolitical Scenario

- The bank lowered its zero-to-three-month gold price to $3,800 per ounce from $4,000, and slashed its silver forecast to $42 per ounce from $55.

- The cuts follow U.S. President Donald Trump’s trade talks with several major trading partners, including Malaysia, Taiwan, and India.

- Some retail traders on Stocktwits said that they intend to buy the dip.

Citi slashed its forecasts for gold and silver prices following a Monday sell-off, citing a shift in global market conditions.

The bank lowered its zero-to-three-month gold price to $3,800 per ounce from $4,000, and slashed its silver forecast to $42 per ounce from $55. Spot gold was trading 2% down at $3,901.23 per ounce at the time of writing, while spot silver was down 2.2% at $45.82 per ounce.

Why Did Citi Lower Price Forecasts?

According to a Reuters report, the cuts follow U.S. President Donald Trump’s trade talks with countries including Malaysia, Thailand, Vietnam, and Cambodia, as well as potential negotiations with Brazil, India, and Taiwan. China's President Xi Jinping has also indicated that he is open to talks, which has reduced the uncertainty that had been pressuring global markets.

The bank also said that a resolution of the U.S. government shutdown and potential slowdown in inflation could also weigh on bullion’s prices. "The litany of worries that are driving gold higher may eventually need to become the base case to sustain this bull run through 2026," Citi said, adding that the medium-to-long-term case to allocate towards gold as a hedge against possible geopolitical and economic concerns remains strong.

What Is Retail Thinking?

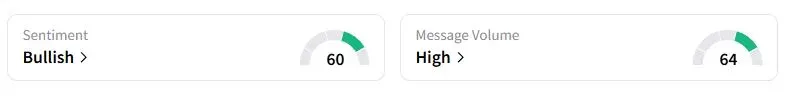

Retail sentiment on Stocktwits about the SPDR Gold Shares ETF (GLD) was still in the ‘bullish’ territory at the time of writing. The GLD ETF was among the top five trending equity tickers on the platform as of early Tuesday.

“What a beautiful dip to add on! Consolidation on the way to $5,000 and will be quick there,” one trader said.

Another user doubted whether Trump and Xi will be able to resolve their differences, as the markets believe.

Bullion has rallied by more than 50% this year, on the back of central bank buying and safe-haven flows. Investor focus will now shift to the Federal Open Market Committee (FOMC) meeting, scheduled to begin on Tuesday. The U.S. central bank is widely expected to deliver a 25-basis-point rate cut, which could pause gold’s declines.

Also See: NextEra Energy Gains Ahead Of Q3 Earnings On Power Supply Deal With Google

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)